Bitcoin Plunges Below $90,000, Wiping Out 2025 Gains in Market Rout

The crypto rally that began in the summer ended in a dramatic turn this November. On October 6, Bitcoin traded near $126,400, buoyed by institutional headlines, ETF inflows and a sense of unstoppable momentum. Just weeks later, Bitcoin plunged below $91,000 for the first time since April, erasing nearly all of its 2025 gains and triggering a violent shake-out across crypto markets.

The sell-off coincided with intensified risk-asset dumping: tech stocks faltered, hopes of a near-term rate cut faded, and broader market capitulation set in.

Key Metrics & Market Signals

Bitcoin’s drop filled a notable CME futures gap around $91K–$92K, a technical zone that often acts as a magnet in volatile phases.

Leveraged liquidations topped $5 billion in the period of sharp selling.

Spot Bitcoin ETFs logged net outflows exceeding $492 million in mid-November, part of broader outflows commanding over $2.3 billion for the month.

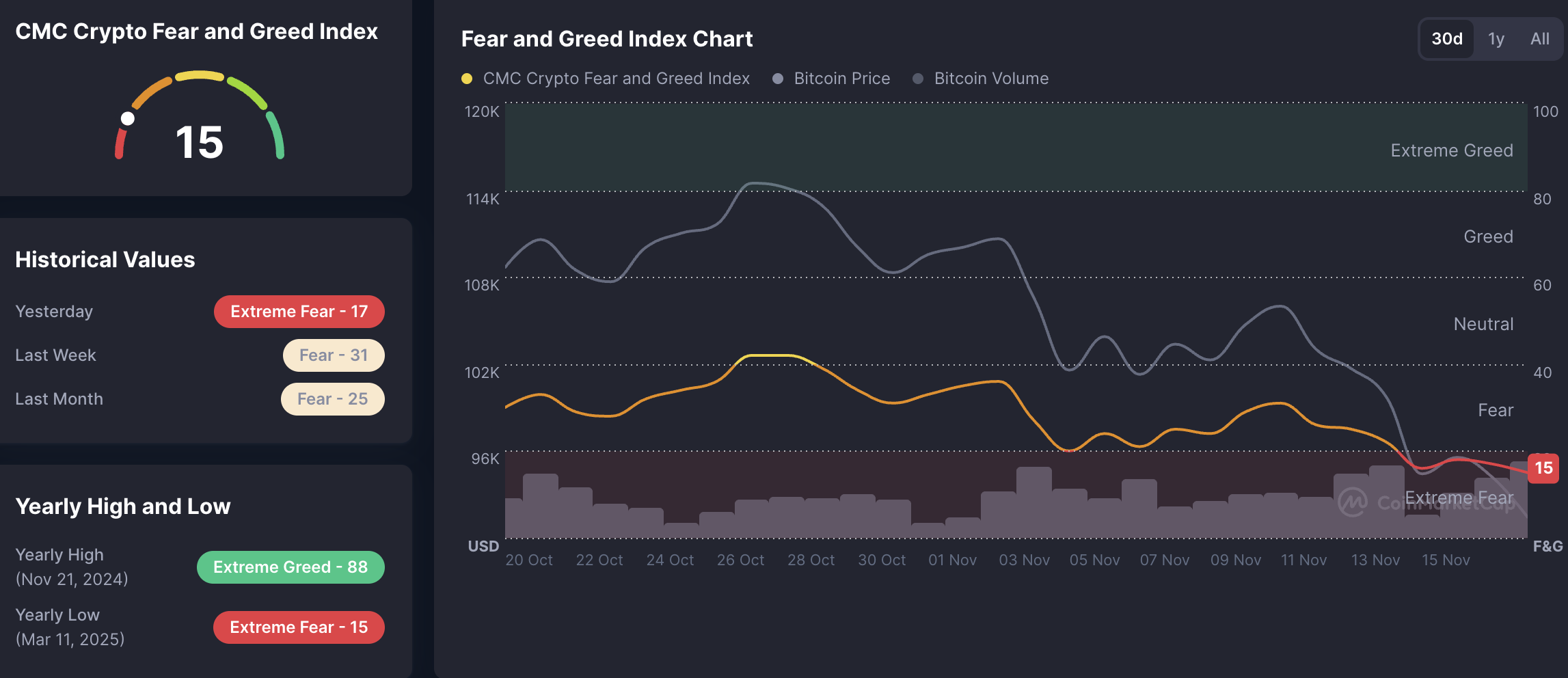

The total crypto market cap has shrunk by more than $1 trillion since early October, and the Crypto Fear & Greed Index plunged to 11, a sign of extreme investor fear.

What’s Driving the Decline?

While the price action is jarring, the underlying cause appears more structural than purely cyclical.

1. Optimism Exhaustion

After a long summer of steady flows and bullish narratives, the market ran out of fresh fuel. The “Uptober” theme failed to hold as momentum dried up and storyline credibility faded.

2. Liquidity & Attention Recession

Capital is still present but willingness to engage isn’t. Exchange trading volumes are down ~45% from their September highs, on-chain activity is stagnant across most ecosystems (except for niche segments), and new retail interest has yet to return in force, especially after the 10.10 liquidations.

3. Macro Headwinds

Expectations of rate cuts from the Federal Reserve were revised downward, increasing the cost of carry for risk assets and inducing broader de-risking across markets.

4. Derivatives Stress without a Blow-Up

This wasn’t an explosive liquidation event like some past cycles. It was a slow drain of leverage, tightening funding rates and widening spreads as liquidity providers gradually walked away.

Timeline: From Peak to Panic

October 6: Bitcoin peaks near $126,400

October–November: Momentum fades, narratives stall

Mid-November: Bitcoin falls below $100,000, then $91,000, fills CME gap

Mid-November: ETF outflows accelerate, market cap drops >$1T

November: Fear & Greed Index hits 10 — extreme fear

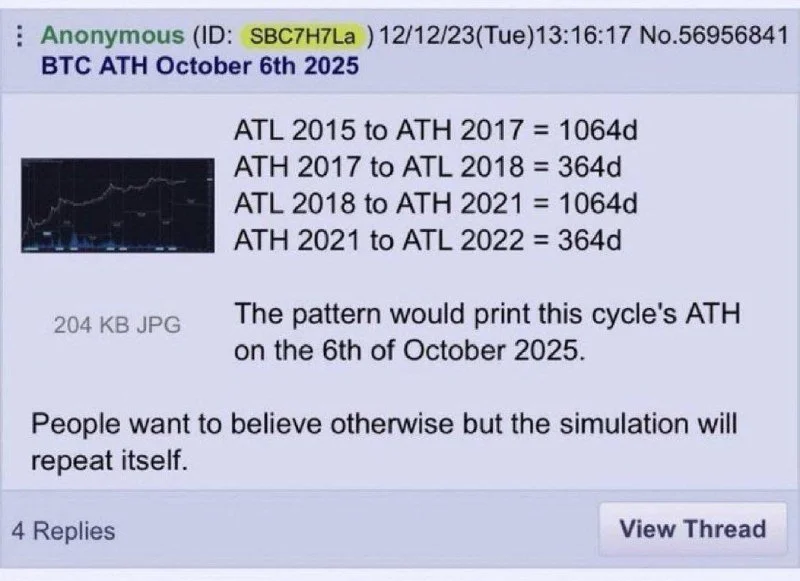

An old anonymous post from 2023 is going viral again because it predicted that Bitcoin’s next all-time high would land on October 6, 2025.

The post claimed Bitcoin follows a repeating pattern: about 1,064 days up from cycle lows to highs, and 364 days down from highs to lows. With Bitcoin recently dropping from $126K to below $91K, some traders are revisiting this chart, wondering if the pattern really is repeating. Whether it’s luck or insight, the post is becoming a talking point as it accurately predicted this cycle’'s all-time-high (ATH).

What It Means for Traders & Investors

Holding cash isn’t a hedge: With risk assets under pressure, sitting out may feel safe, but inflation and opportunity cost still bite.

Beware liquidity traps: Thin order books and stale narratives increase vulnerability to sharp moves.

Derivatives risk is real: Leverage unwinds quietly can still amplify losses.

Narrative renewal may be key: Until new drivers of demand emerge, markets may remain range-bound or drift lower.

Conclusion: A Market Reset, Not Just a Drawdown

The drop from $126K to below $91K marks more than just a correction — it signals a reset in market psychology. The optimism that carried crypto through the summer gave way to liquidity fatigue, narrative exhaustion and macro uncertainty. The rally phase may not be over, but the rules have changed: steady flows alone no longer suffice.

For now, markets are operating in fear mode, and participants are re-evaluating entry points, risk structures and belief systems. The next move may well depend not on a new headline, but on the emergence of fresh, credible catalysts. Until then, volatility remains high and conviction remains muted.