Bitcoin Surges Past $94K as Geopolitical Shock Fuels Crypto Rally

Summary: Bitcoin rocketed to four-week highs above $94,000 following the dramatic U.S. ousting of Venezuelan President Nicolás Maduro, igniting a risk-on frenzy across crypto markets despite analyst warnings of fragile momentum and potential pullbacks.

Key Insights

Bitcoin hits $93,800, marking its highest level in four weeks as risk appetite returns to crypto markets with total market cap reaching $3.27 trillion

Venezuela's Maduro ouster sparked the rally, with the geopolitical shock triggering speculation about the country's rumored Bitcoin reserves and future crypto policy

XRP outperforms with 18%+ gains, fueled by optimism around crypto-friendly SEC leadership and potential ETF approvals, while Ethereum hovers near $3,150

Analysts warn of "bull trap" risks, citing fragile liquidity, uneven altcoin performance, and potential pullback to $80K if momentum fades

The crypto markets woke up to chaos and opportunity on Tuesday.

Bitcoin, the world's largest cryptocurrency, briefly pierced the $93,800 mark (its highest level in nearly a month) before settling into a comfortable perch around $92,500. The 2-3% surge in 24 hours might seem modest by crypto's volatile standards, but the catalyst behind it reads like a geopolitical thriller.

When Politics Meets Digital Gold

The spark? A stunning development in Venezuela. The United States successfully ousted President Nicolás Maduro, a move that sent shockwaves through traditional markets and crypto trading floors alike. What initially looked like a risk-off moment, prices dipped briefly on the news, quickly transformed into a buying opportunity.

Traders piled in, betting that political instability would drive capital toward decentralized assets. But there's another wrinkle: Venezuela's rumored "shadow" Bitcoin holdings, remnants of the country's failed Petro cryptocurrency experiment and state-backed mining operations, have suddenly become relevant again. Could these reserves enter global markets? Might a new government adopt a different crypto strategy entirely?

The market decided not to wait for answers.

The Resilience Test

Bitcoin's rapid recovery from the initial shock demonstrated something analysts have been debating for years: whether the digital asset truly functions as "digital gold" during geopolitical turbulence. Today, it passed with flying colors.

The broader crypto market cap now stands at approximately $3.27 trillion, up roughly 2% in recent trading. But beneath the headline numbers, a more nuanced story emerges.

The Altcoin Awakening

While Bitcoin grabbed headlines, XRP stole the show with performance that would make any portfolio manager jealous. The cryptocurrency surged past $2.17, notching gains of 3-4% on the day and extending recent rallies to over 18%. The fuel? Growing optimism around a crypto-friendly Securities and Exchange Commission leadership and whispers of potential ETF approvals.

Ethereum, often called Bitcoin's sophisticated younger sibling, traded steadily near $3,150. Co-founder Vitalik Buterin chose this moment to unveil ambitious long-term scaling plans extending through 2030, including ZK-EVM technology and PeerDAS implementation—technical solutions aimed at solving the infamous "blockchain trilemma" of scalability, security, and decentralization.

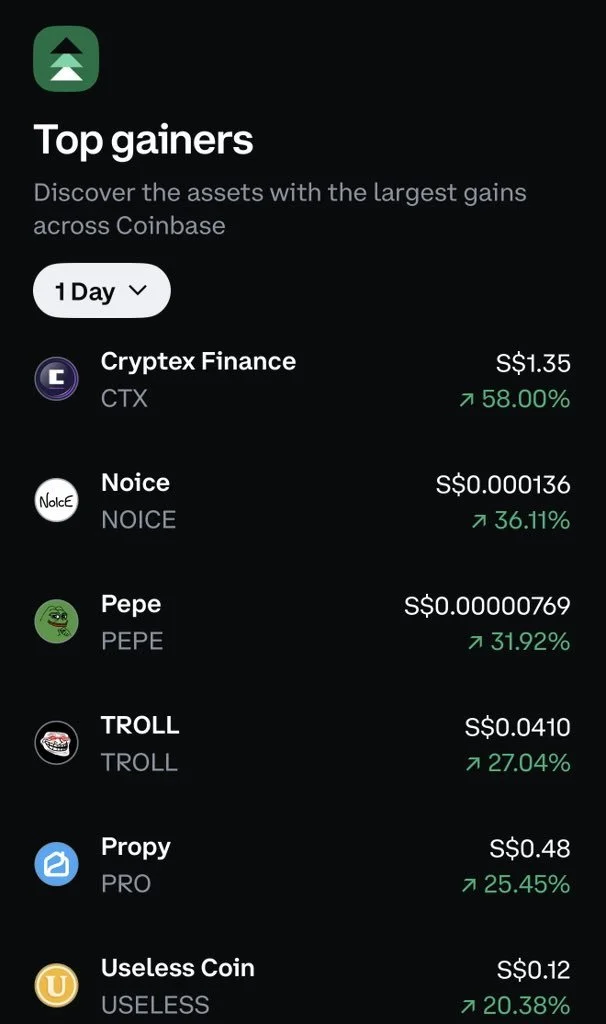

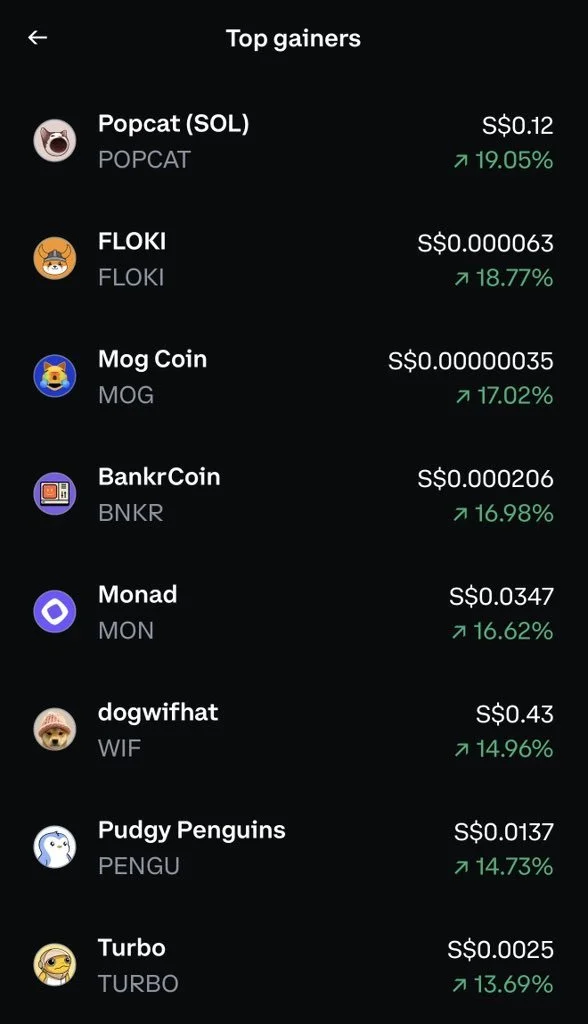

Even memecoins joined the party.

Dogecoin, the Shiba Inu-themed token that started as a joke, posted substantial weekly gains as speculative fervor returned. Cronos (CRO) and Polygon (POL) also climbed index rankings.

The Warning Signs

But not everyone is popping champagne.

Veteran analysts are flashing yellow lights. Market liquidity remains "fragile," according to multiple trading desks. Altcoin performance is "uneven," suggesting the rally lacks broad-based conviction. And perhaps most concerning: whispers of a potential "bull trap", which means a false breakout that could see Bitcoin tumble back toward $80,000 if momentum evaporates.

The pattern is familiar to crypto veterans: a dramatic price spike on dramatic news, followed by exhaustion as buyers retreat and sellers emerge. The question isn't whether Bitcoin can reach $93,000. It just did. The question is whether it can stay there.

What Happens Next

The coming days will reveal whether this rally has legs or lungs. Key factors to watch include:

How traditional equity markets digest the Venezuela news

Whether institutional buyers join retail enthusiasm

Trading volume sustainability (thin volume often precedes reversals)

Regulatory signals from the newly configured SEC

For now, crypto traders are enjoying the ride, geopolitical drama has reminded markets that Bitcoin operates in a complex global ecosystem, and the age-old debate continues: Is this digital asset a hedge, a speculation, or something entirely new?