Monad Founder Defends 'Undersubscribed' Token Sale Strategy, Says Broad Distribution Beats Hype

Monad founder Keone Hon has broken his silence on the crypto community's lukewarm reception to the project's token sale on Coinbase, defending the team's decision to prioritize broad distribution over the hype-driven mechanics that have dominated 2025's token launch season.

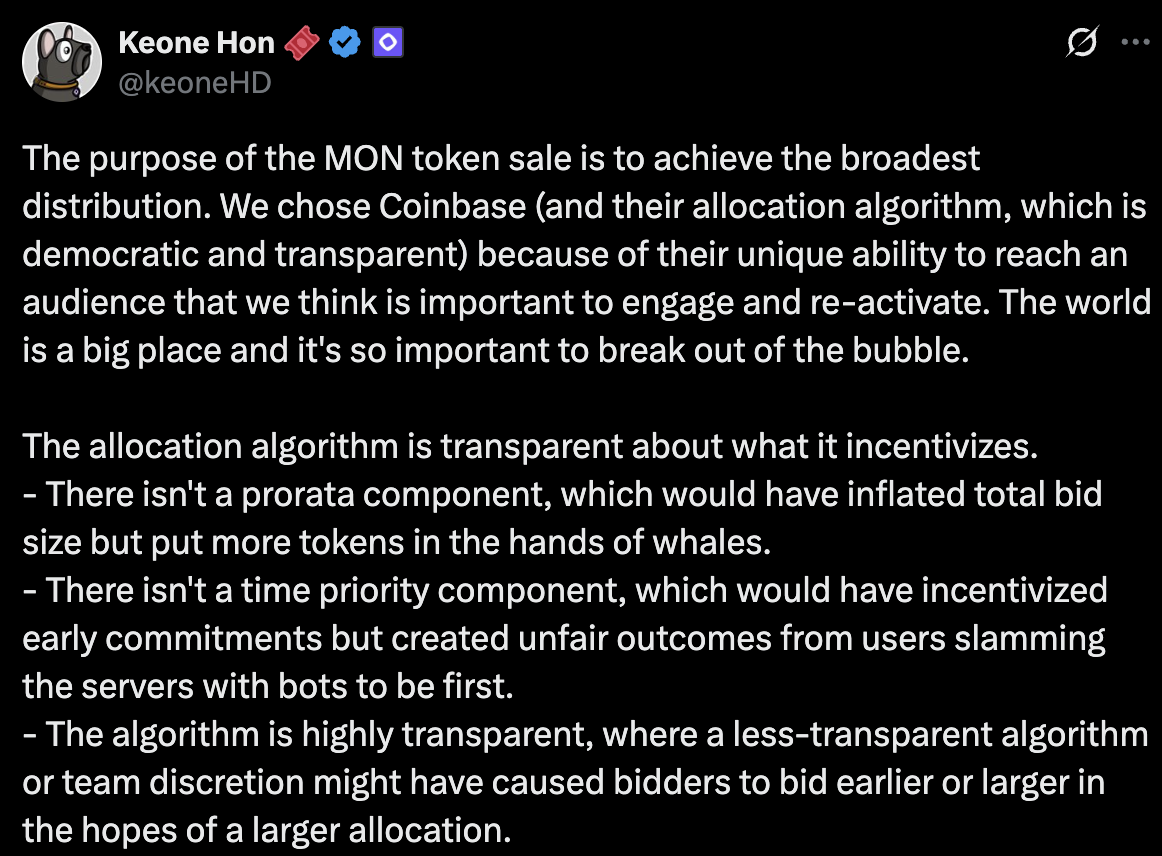

In a detailed statement posted to X (formerly Twitter) on Tuesday, Hon addressed what some observers called a "disappointing" and "undersubscribed" funding round, arguing that the outcome reflects a deliberate strategic choice rather than lack of demand.

Why Monad Chose a Different Path

The MON token sale, conducted through Coinbase's platform, diverged significantly from the playbook used by most high-profile crypto projects this year.

Rather than engineering terms designed to create headlines about being "10x oversubscribed," Monad opted for what Hon describes as a more transparent and democratic approach.

"Token sales are a major trend this year, and with many sales, there is a sense in which the sale terms are constructed to make the outcome sound as impressive as possible," Hon wrote. "To me that always seemed a little cheesy, and like a short-term optimization."

Monad’s token sale on Coinbase

The Monad team selected Coinbase specifically for its allocation algorithm, which Hon praised as "democratic and transparent." Critically, the algorithm differs from typical token sale mechanics in three key ways:

No pro-rata component that would favor large investors (or "whales") who could inflate total bid sizes

No time-priority mechanism that would create advantages for early bidders and incentivize bot activity

Full transparency in allocation methodology, removing the guesswork that typically drives speculative bidding behavior

Breaking Out of the Bubble

Central to Hon's argument is the belief that reaching beyond crypto's existing community matters more than maximizing immediate token sale metrics.

"The world is a big place and it's so important to break out of the bubble," Hon explained, noting that Coinbase's unique reach allows Monad to engage users who might otherwise never participate in a token sale.

The sale structure gave participants 5.5 days to commit funds, with commitments locked once made. Hon acknowledged this creates an "interesting dynamic" where users are incentivized to wait until the last minute to evaluate their decision, a feature the team might revisit for future sales.

"For someone on Crypto Twitter, that optionality might be a big deal. For someone not in our bubble, maybe not so much," he said.

The VC Playbook Parallel

Hon drew parallels to his experience raising venture capital, where founders are often advised to artificially inflate interest to create FOMO (fear of missing out) among other investors.

"People would advise me to gather as much VC interest as possible in order to pitch to other VCs that 'this round is 10x oversubscribed' to get them to FOMO in. I was never interested in doing that though," Hon recalled. "Smart people see through the gamesmanship anyway."

This philosophy appears to have carried over into Monad's token distribution strategy, even as it opens the team to criticism from observers accustomed to different success metrics.

What This Means for Token Sales

Monad's approach represents a potential inflection point for how blockchain projects think about token distribution. While 2025 has seen numerous projects compete for the most impressive oversubscription numbers, Hon's comments suggest some founders are questioning whether those metrics actually serve long-term project health.

The emphasis on broad distribution over concentrated holdings aligns with crypto's founding ethos of decentralization, though it may come at the cost of the short-term price action that often follows artificially constrained token sales.

"Better to be transparent and to focus on the stakeholders who will be most beneficial to the project's growth," Hon concluded, adding that he's "grateful for the opportunity to try something different."

Community Reaction

The crypto community's response to Hon's explanation has been mixed. Some praised the transparency and long-term thinking, while others questioned whether the approach might have left money on the table or signaled weak demand.

As token sales continue to evolve in 2025, Monad's experiment with democratic distribution may offer lessons for future projects weighing short-term optics against long-term community building.

This is a developing story and will be updated as more information becomes available.