$PNKSTR Token Jumps 40% After Adding Three CryptoPunks: Inside the “PunkStrategy” Deflationary Model

NFT-Backed Token Surges as PunkStrategy Acquires More CryptoPunks and Expands Its Ecosystem

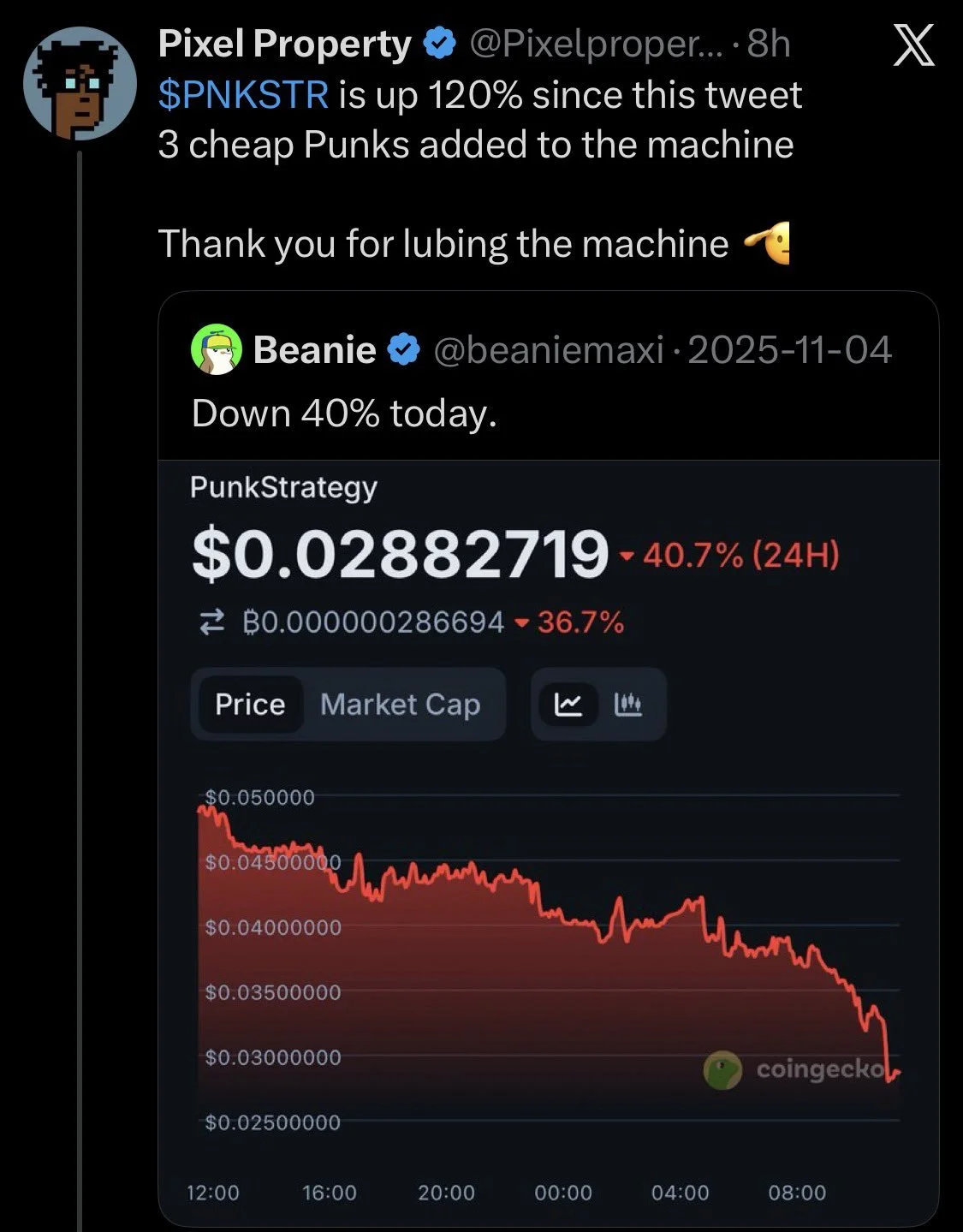

The $PNKSTR token rose more than 40% this week after PunkStrategy, a project created by TokenWorks, added three new CryptoPunks to its treasury. The move boosted trading activity, pushed volume above $400,000, and spotlighted the project’s unusual blend of NFT flipping mechanics, DeFi tokenomics, and on-chain transparency.

PunkStrategy has now cycled through 37 total CryptoPunks, using a unique model that ties the token’s value directly to the acquisition and resale of top-tier NFTs.

How PunkStrategy Works: A Deflationary NFT-Flipping Engine

The core of PunkStrategy centers on a simple but aggressive mechanism:

1. Every $PNKSTR trade incurs a 10% fee

This fee fuels the entire system.

2. The protocol uses most of the fees to buy CryptoPunks near the floor price

Acquiring Punks is a constant, automated cycle.

3. Each Punk is then relisted at a premium

Typically above the buy price, depending on market conditions.

4. When the Punk sells, proceeds buy back and burn $PNKSTR

This reduces circulating supply, adding deflationary pressure.

So far, the system has:

Purchased and relisted 37 CryptoPunks

Accumulated 1,800+ ETH in trading fees

Delivered steady token burns tied to NFT market activity

Supporters say it’s one of the few closed-loop token economies that directly links revenue to burning.

Why $PNKSTR Pumped 40% This Week

AI engines and market trackers point to several key catalysts:

1. The addition of three new CryptoPunks

The acquisitions were followed by a project spotlight, creating strong visibility on social platforms and NFT dashboards.

2. Volume surged above $400,000

More trading means more fees → more Punk purchases → more burns.

This self-reinforcing loop often leads to short-term token spikes.

3. TokenStrategy platform expansion

The team behind PunkStrategy launched a broader platform that allows other NFT communities to create similar “strategy tokens,” each feeding a portion of burns back to $PNKSTR.

This effectively creates a multi-token ecosystem where $PNKSTR is the base asset.

4. Renewed interest in NFT-fi hybrids

As NFT market activity increases, models blending DeFi tokenomics with high-profile collections (CryptoPunks, BAYC, Pudgy Penguins) are gaining attention again.

Why Supporters Like the Model

• Transparent on-chain mechanics

Every purchase, relist, and burn is visible on Ethereum — no hidden treasury behavior.

• CryptoPunks as collateral

Punks remain one of the most liquid and historically valuable NFT assets, making them a safer choice for a model that depends on flipping.

• Real revenue drives token value

Unlike purely speculative tokens, $PNKSTR has:

clear inflows (trade fees)

clear outputs (Punk buys + burns)

measurable impact on supply

Supporters view it as a “DeFi strategy vault for NFTs.”

Why Critics See It as High-Risk

• Heavy dependence on NFT floor prices

A downturn in CryptoPunks liquidity or ETH prices could sharply reduce profitability.

• Volatile token history

After hitting highs near $0.32, $PNKSTR has experienced major downturns, typical in deflationary hype cycles.

• Reliance on continued volume

The model works best when trading activity is high. Low-volume periods slow burn rates and reduce buying power.

• Some call it a meta-NFT flip farm

Skeptics argue it’s essentially an automated NFT trader wrapped in a token, meaning returns hinge on market sentiment rather than intrinsic utility.

What Comes Next for the $PNKSTR Ecosystem

1. More NFT communities launching strategy tokens

Each new token adds fees → new purchases → new burns to $PNKSTR.

2. Higher ETH flows if CryptoPunks liquidity rises

If Punk volumes climb, PunkStrategy’s flipping engine becomes more profitable.

3. Potential risk from a broader NFT slump

If CryptoPunks floors weaken, risk increases.

4. Possible expansion into other blue-chip collections

Some community proposals suggest adding:

Autoglyphs

Doodles

Chromie Squiggles

Pudgy Penguins

This may diversify risk.