POPCAT Got Nuked: What Actually Happened on Hyperliquid

POPCAT traders woke up to chaos after the meme coin suffered a massive pump-and-dump that liquidated an eye-watering $63 million worth of positions on Hyperliquid.

POPCAT suddenly mooned, then instantly fall off a cliff.

Event Summary

Onchain transaction mapping by MLM, LookonChain, Arkham, and independent analysts indicates the actions stemmed from a single coordinated operator:

Here’s how the attack worked:

$3M of USDC was withdrawn from OKX

The funds were split across 19 new wallets

$20M–$30M in leveraged POPCAT longs were opened

A fake Buy wall built at $0.21

Wall removed → price crashed

Hyperliquid’s community-owned HLP vault absorbed the damage

Even the attacker’s entire $3M stake was wiped out

Source: Lookonchain

Source: Lookonchain

The incident follows the major market hit on 10/10, adding to concerns about ongoing manipulation and thin-liquidity vulnerabilities on onchain derivatives platforms.

Hyperliquid’s Response

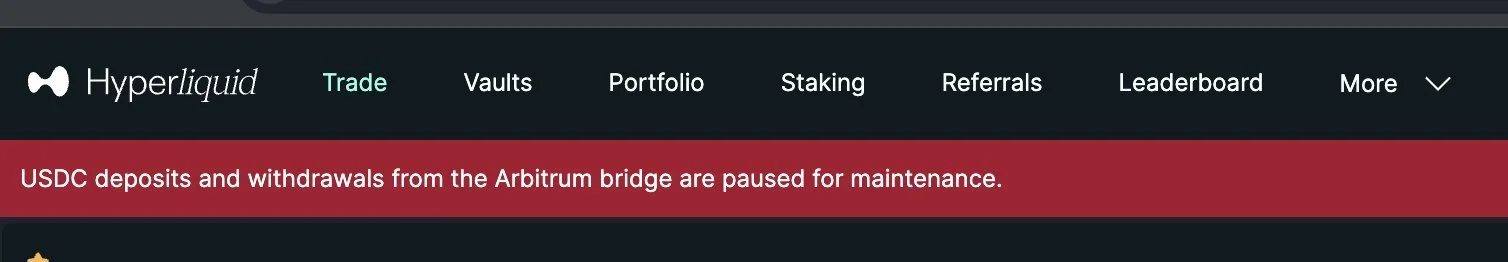

Hyperliquid took immediate action, temporarily pausing its Arbitrum bridge to prevent further cross-chain contagion

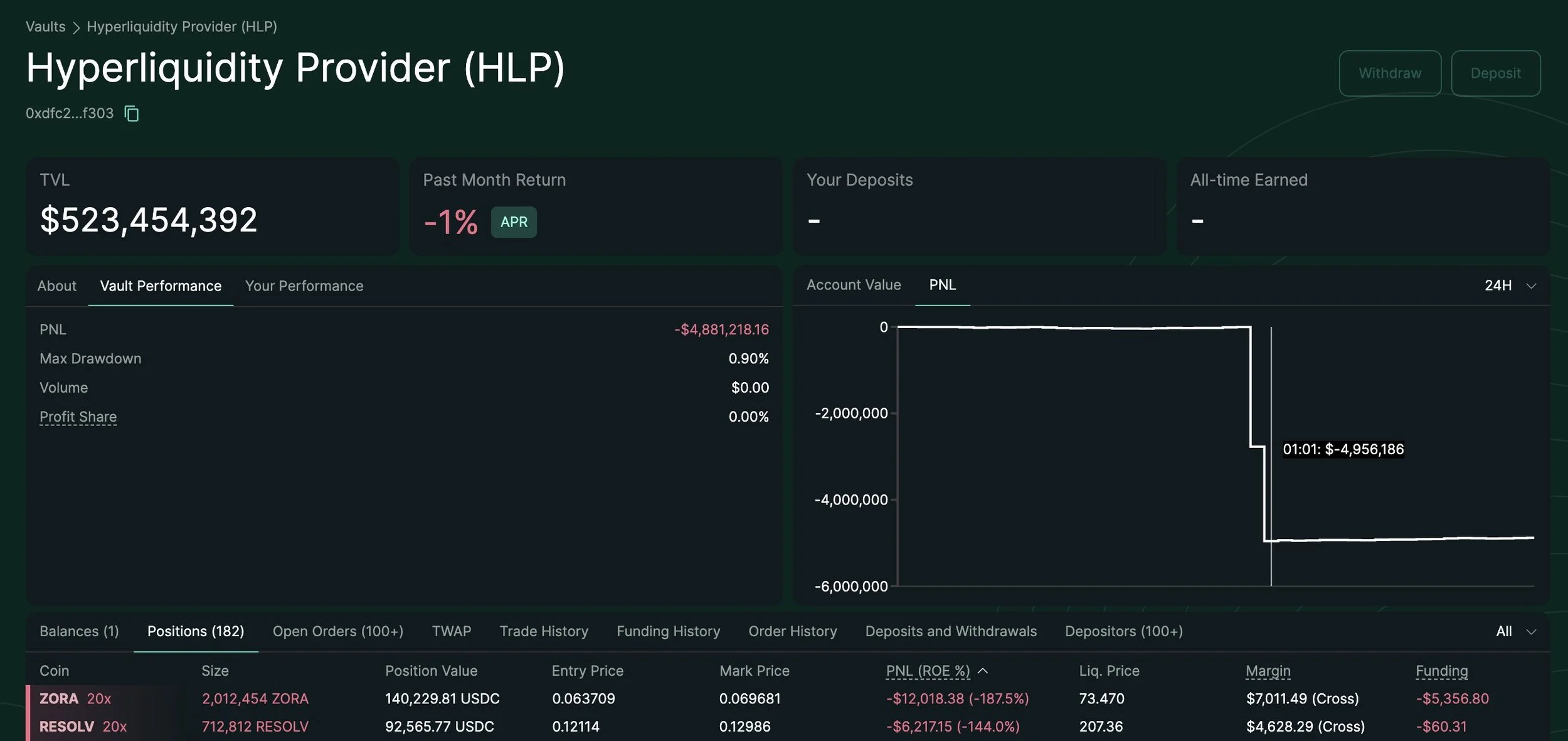

Hyperliquid’s community-owned HLP vault had to cover the losses once trader collateral ran out, ending up with $4.9 million in bad debt and adding to the damage from the attack.

These changes suggest that DEXs may move toward more centralized controls to manage systemic risk, a notable evolution in decentralized platforms’ governance.

What Is the HLP Vault on Hyperliquid?

The HLP vault is Hyperliquid’s pooled liquidity system, essentially the house that takes the opposite side of traders’ positions. It functions similarly to how a traditional market maker or exchange risk engine would operate, but in a decentralized, automated form.

Here’s what that means:

1. The HLP Vault Is the Platform’s Liquidity Pool

Users deposit assets into the HLP vault (similar to an index fund).

These deposited assets act as backing liquidity for Hyperliquid’s perpetual futures trading.

When traders place long or short positions, the HLP vault takes the other side of those trades.

Think of it as a shared market-making pool managed by smart contracts.

2. HLP Earns Profits From Trader Losses

When traders lose money on Hyperliquid:

Their losses flow into the HLP vault

The vault’s balance increases

HLP depositors earn yield from these trading losses

This is why many users deposit into HLP. Historically, most traders lose over time, similar to centralized exchanges.

3. HLP Takes Losses When Traders Win

The flip side:

If traders win big, especially during violent price moves, the HLP vault absorbs those losses.

That’s exactly what happened in the POPCAT event:

Traders were liquidated in a cascade

HLP had to pay out the winning side of the trades

This resulted in a $4.9 million loss for the vault

Even though the attacker lost their $3M position, the liquidation mechanics caused a net negative outcome for HLP.

4. HLP Is Shared Risk

All HLP depositors collectively share:

the profits

the losses

the volatility

the exposure to manipulation events

Unlike a CEX where the company internalizes these risks, Hyperliquid spreads it across the liquidity providers.

5. Why It Matters in This Incident

The POPCAT manipulation exposed a structural weakness:

Thin liquidity + high leverage + a large buy wall = severe slippage

The liquidation engine had to fill positions against the HLP vault at bad prices

Resulting in millions in realized losses for the pool

This highlighted the systemic risk of having a single shared vault backing a volatile meme-coin perpetual pair.

Broader Significance

The POPCAT liquidation incident has renewed debate over the structural vulnerabilities of onchain perpetual trading, particularly for low-cap, high-volatility tokens. While Hyperliquid acted quickly to contain the immediate fallout, the event underscores the need for more robust market-protection mechanisms as decentralized derivatives platforms continue to scale.

This incident will likely serve as another case study in how onchain transparency allows rapid post-event forensics, yet prevention mechanisms are still underdeveloped compared to centralized venues.

As institutional participation in onchain derivatives grows, the demand for higher-grade risk infrastructure, adversarial simulations, and surveillance tooling will become increasingly critical.

Update: BTX Capital is suspected to be behind this attack

https://x.com/SpecterAnalyst/status/1989337031525175669?s=20