The Ghost of FTX Returns: SBF’s 10,000-Word Jailhouse Manifesto and the Internet’s Savage Reply

He’s back.

From the sterile confines of federal prison, Sam Bankman-Fried is back. The disgraced FTX founder, convicted fraudster, and the crypto world’s most infamous villain has resurfaced on X with a 10,000-word bombshell.

Posted on Halloween night, the sprawling document reads like a legal brief, a TED Talk, and a cry for help all rolled into one.

Titled something to the effect of “FTX Was Never Insolvent”, it’s SBF’s most audacious attempt yet to rewrite history from behind bars.

And the internet? It’s not having it.

The Manifesto: Key Claims in SBF’s Own Words

Here’s the TL;DR of what Sam wants you to believe:

FTX was 100% solvent at the time of collapse.

“Customer deposits were fully backed. We had enough assets to repay every user. In full, in kind.”

The bankruptcy team destroyed $136 billion in value.

SBF accuses lawyers from Sullivan & Cromwell and the restructuring team of forcing a premature Chapter 11 filing, liquidating assets at the worst possible time, and creating a self-fulfilling prophecy of insolvency.If they’d just held on, victims would be rich today.

With Bitcoin at ~$70K and Solana up 10x from 2022 lows, SBF claims the estate would now be worth over $100 billion, meaning creditors could’ve been overpaid, not just made whole.This is all prosecutorial overreach.

Subtle nods to the incoming Trump administration, hints at pardon lobbying, and a not-so-subtle suggestion that the Biden DOJ “weaponized” the case.

There’s even a chart: “This is where the money went.”

(Spoiler: it’s a lot of arrows pointing to Alameda Research, his hedge fund that allegedly siphoned $8 billion in customer funds.)

The Response: Mostly Mockery, Skepticism, and Schadenfreude

The tone? Equal parts disbelief, rage, and meme-fueled glee. Adam Cochran didn’t mince words:

On-chain sleuth ZachXBT was equally blunt:

Even industry insiders couldn’t resist joining the pile-on. Arthur Hayes chimed in with a classic troll:

“Wen memecoin?”

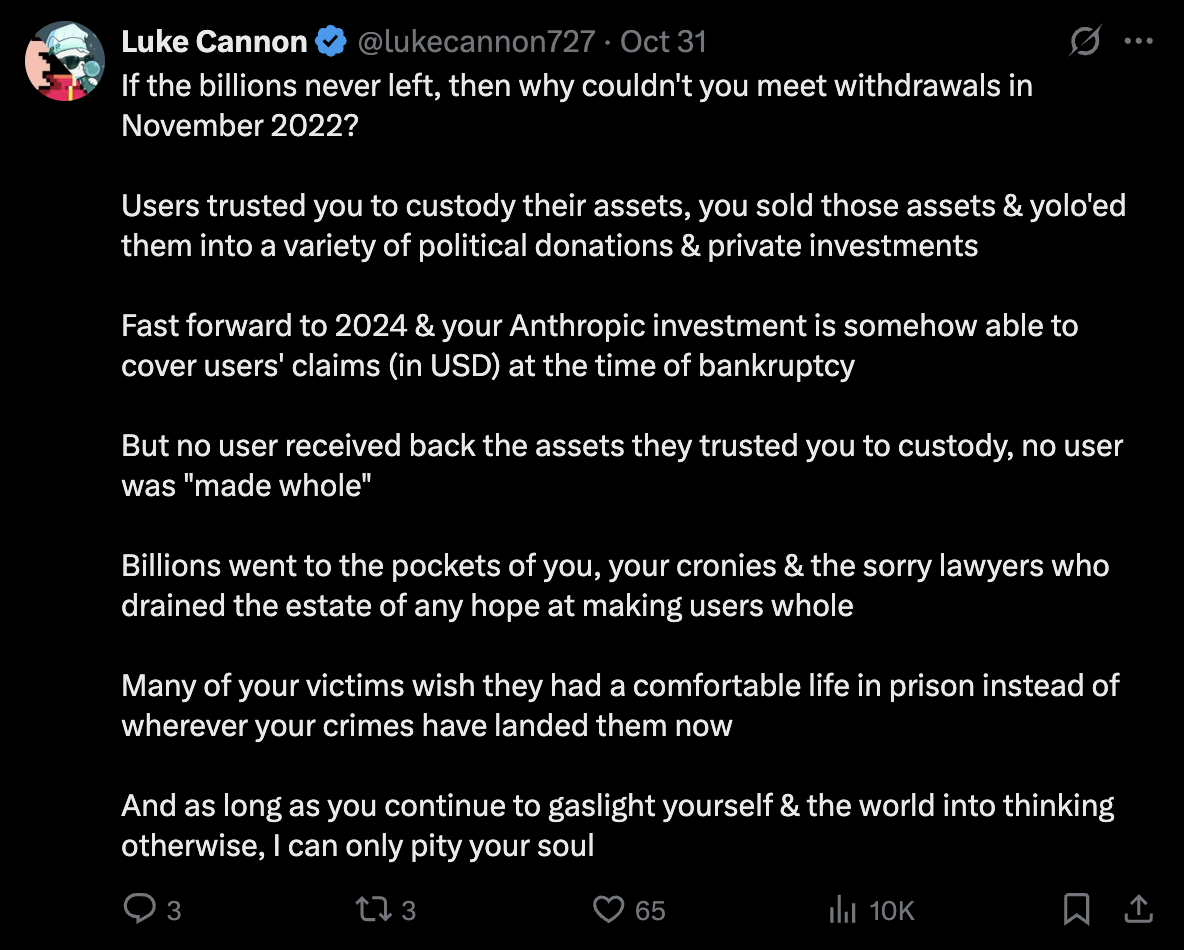

Amid the memes and mockery, a few voices tried to inject reality: creditors pointing out that “hypothetical future valuations” don’t erase the fact that people couldn’t withdraw their funds in 2022. As one commenter put it,

“You clearly haven’t learned anything in prison. you’re repeating the same misinformation as before.”

In short, Crypto Twitter read SBF’s comeback not as redemption, but as relapse. The verdict was swift and nearly unanimous: the only thing more inflated than FTX’s balance sheet is Sam’s ego.

The Credibility Problem (In One Sentence)

SBF is the guy who testified under oath that he didn’t know Alameda was using customer funds then got convicted on seven counts of fraud and conspiracy.

His defense now?

“Actually, everything was fine. You just panicked.”

It’s like the captain of the Titanic tweeting:

“The ship never sank. The water just got too high.”