Venezuela's Secret Bitcoin Fortress: Inside Its $67 Billion Shadow Reserve

One-sentence summary: The U.S. military capture of Venezuelan President Nicolás Maduro on January 3, 2026, has exposed intelligence reports of a massive 600,000-660,000 BTC shadow reserve worth up to $67 billion. It is potentially one of the largest undeclared sovereign cryptocurrency accumulations in history, built through gold conversions and oil settlements to evade sanctions.

Key Insights

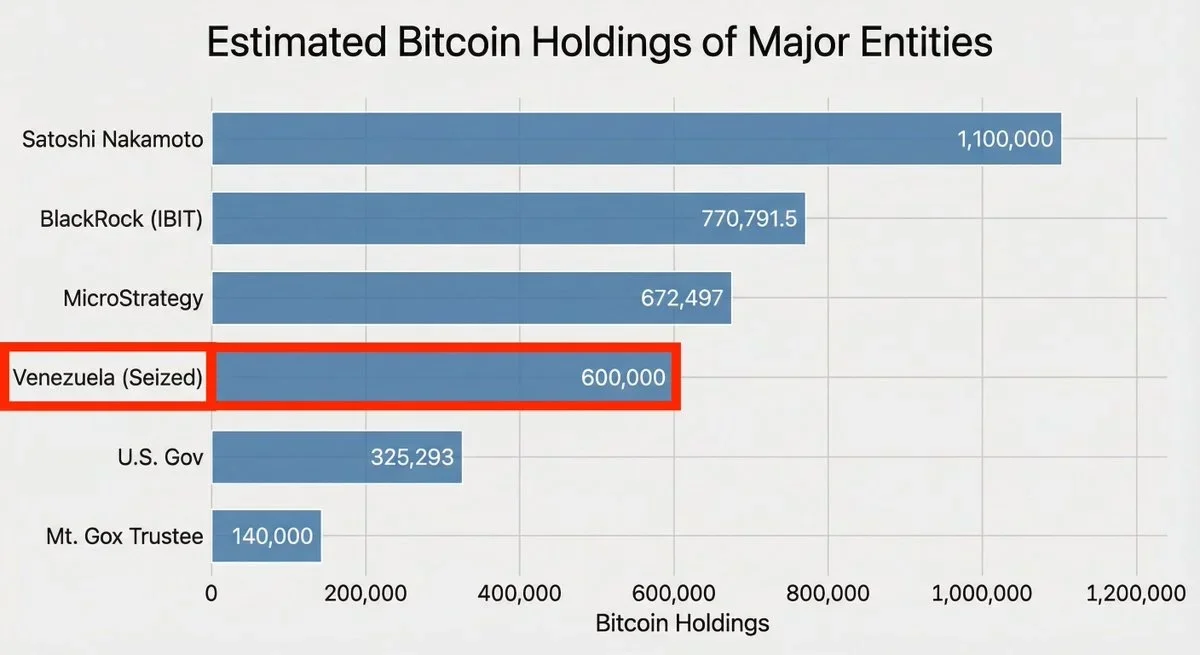

660,000 BTC allegedly hidden by the Maduro regime represents roughly 3% of Bitcoin's entire circulating supply, valued at $56-67 billion—potentially rivaling or exceeding MicroStrategy's holdings and ranking among the world's largest Bitcoin treasuries

Built through sanctions evasion since 2018, the shadow reserve reportedly accumulated through converting $2 billion in Venezuelan gold at $5,000-10,000 per BTC, plus $10-15 billion in oil export settlements paid in USDT and swapped to Bitcoin

Private keys remain missing, with U.S. authorities racing to recover access through interrogations and plea deals with key figure Alex Saab—creating potential for a historic supply shock if 3% of all Bitcoin gets frozen in legal limbo for years

Market already reacting: Bitcoin briefly dipped to $89K on invasion news before surging to multi-week highs around $93K, as traders speculate on scenarios ranging from U.S. Strategic Bitcoin Reserve additions to Venezuelan reconstruction financing

Delta Force doesn't usually make Bitcoin investors rich. But January 3, 2026, wasn't a usual day.

When U.S. special operations forces descended on Caracas in a dramatic raid, explosions lighting up military bases, helicopters sweeping over presidential compounds. Most observers saw regime change.

Crypto traders saw something else entirely: the biggest Bitcoin mystery in history, suddenly cracked wide open.

Nicolás Maduro, Venezuela's embattled president, was en route to a Brooklyn detention center within hours. His charges read like a narco-thriller: terrorism, drug trafficking, weapons offenses tied to the notorious "Cartel de los Soles." But buried beneath the headlines was a different story, one that sent shockwaves through trading floors from Singapore to New York.

Venezuela might be sitting on 600,000 to 660,000 Bitcoin. And nobody knows where the keys are.

Source: Futuu

The Shadow Reserve

The numbers sound impossible. At current prices hovering around $92,000-94,000 per Bitcoin, we're talking about $56 billion to $67 billion in digital assets. That's roughly 3% of Bitcoin's entire circulating supply. It would place Venezuela among the world's largest Bitcoin holders, potentially exceeding Strategy's celebrated corporate treasury and rivaling some nation-state reserves.

The caveat? These figures remain unverified. No blockchain explorer shows Venezuelan government wallets holding anywhere near this amount. Official tracked addresses reveal a mere 240 BTC as of late 2022-2025. The claims stem from intelligence reports, anonymous sources, and investigative journalism.

But the story of how this reserve allegedly came to exist is too detailed, too consistent across multiple sources, to dismiss entirely. And it begins with desperation.

How to Buy 660,000 Bitcoin Without Anyone Noticing

Phase One: The Gold Conversion (2018-2020)

Picture Venezuela in 2018. U.S. sanctions tightening like a noose. International banks severing ties. Traditional assets frozen or inaccessible. The Maduro regime needed a lifeline that governments couldn't touch.

The answer glittered in the Orinoco Mining Arc—one of Venezuela's major gold-producing regions. In 2018 alone, Venezuela exported 73.2 tons of gold worth $2.7 billion. But here's where the story gets interesting: intelligence reports suggest approximately $2 billion of those proceeds never entered traditional financial systems.

Instead, they allegedly bought Bitcoin. Lots of it.

The timing was perfect, if you can call economic catastrophe perfect. Bitcoin prices during 2018-2020 ranged from $5,000 to $10,000—a bear-to-bull transition that seems quaint now. At those prices, $2 billion could purchase roughly 400,000 BTC. The same stash today? Worth over $37 billion.

It was sanctions evasion as investment strategy. And it worked spectacularly—if the reports are accurate.

Phase Two: The Petro Failure and the Pivot (2018-2023)

Venezuela launched its own state-backed cryptocurrency, the Petro, in February 2018 with great fanfare. Tied to the country's oil and mineral reserves, it was supposed to revolutionize how sanctioned nations conduct business.

It was also a spectacular failure. Widely dismissed as a scam or ineffective tool, the Petro was essentially abandoned by 2024. But the experience taught the regime a crucial lesson: if you want sanctions-resistant money, don't create it yourself. Use what already exists.

While ordinary Venezuelans turned to Bitcoin for remittances and inflation hedging—the country's hyperinflation made the local currency worthless—the government pivoted toward a more ambitious strategy.

Phase Three: Oil for Crypto (2023-2025)

By 2023, Venezuela's state oil company PDVSA faced a problem. Western buyers were largely gone due to sanctions. The buyers who remained weren't using dollars. They were using Tether.

Reports suggest that up to 80% of Venezuela's crude oil exports in late 2025 were settled in USDT—the dollar-pegged stablecoin. We're talking about $10-15 billion flowing through digital channels, transactions that left no traditional paper trail.

But Tether presented its own risk. The company can freeze addresses at U.S. government request. Sitting on billions in USDT was like keeping your getaway money in a bank that your enemy controls.

The alleged solution? Wash the USDT into Bitcoin through complex swap networks. Bitcoin couldn't be frozen as easily. Its decentralization offered genuine protection.

This phase reportedly added the bulk of the later holdings, transforming Venezuela's crypto strategy from opportunistic to systematic.

Phase Four: Mining Seizures

Venezuela's cheap hydroelectric power made it attractive to Bitcoin miners despite frequent grid failures. The government's response was predictably authoritarian: crack down on unlicensed operations, confiscate hardware, seize coins.

A full mining ban in May 2024, ostensibly citing energy strain, gave authorities cover to raid operations and appropriate assets. Estimates suggest $500 million to $5 billion worth of Bitcoin entered government hands this way—though these figures, like everything else in this story, remain impossible to verify independently.

The Man Who Might Hold the Keys

If this Bitcoin exists, someone has to know how to access it. Enter Alex Saab.

Described alternately as a Maduro financier, sanctions evader, and—in a plot twist worthy of spy fiction—a DEA informant since 2016, Saab is believed to be the architect of Venezuela's shadow financial system. He allegedly orchestrated the network that moved billions through cryptocurrency channels while keeping the regime afloat.

Saab's cooperation—or lack thereof—may determine whether this Bitcoin fortune ever surfaces. Is he talking? Does he even have the keys? Did multiple regime insiders hold pieces of the puzzle, and are some now unreachable?

The U.S. authorities are reportedly racing to find out, using interrogations, plea deals, and legal pressure to unlock what could be the biggest cryptocurrency seizure in history.

What Happens Next: Four Scenarios

Scenario 1: The Forever Freeze

U.S. authorities locate the keys and immediately freeze the assets. Legal proceedings drag on for years—think decades, not quarters. Three percent of Bitcoin's supply becomes locked in jurisdictional limbo, removed from circulation as effectively as if the keys were lost. For Bitcoin's price? Potentially massive bullish pressure from reduced supply.

Scenario 2: Strategic Reserve

The Bitcoin flows into the U.S. Strategic Bitcoin Reserve—an initiative President Trump has championed. Suddenly America becomes one of the world's largest Bitcoin holders overnight, legitimizing cryptocurrency as a sovereign reserve asset and potentially triggering a global race for digital asset accumulation.

Scenario 3: Reconstruction Financing

A transitional Venezuelan government gains control and uses the Bitcoin for reconstruction. Opposition leader María Corina Machado has already signaled that BTC could play a role in future national reserves. Venezuela becomes a case study in cryptocurrency-backed national rebuilding—and potentially a crypto-friendly jurisdiction going forward.

Scenario 4: The Keys Are Gone

The darkest possibility: the Bitcoin is lost forever. Keys were destroyed, holders died without sharing access, or paranoid compartmentalization meant no single person had complete control. 660,000 BTC becomes a ghost story, simultaneously worth $67 billion and $0.

The Market's Verdict (So Far)

Bitcoin's reaction to Maduro's capture tells its own story. Initial risk-off jitters sent prices briefly to around $89,000—a modest 0.5-1% dip. But the recovery was swift and emphatic, with BTC surging to multi-week highs around $93,000-94,000 before stabilizing around $92,500.

The pattern suggests markets view this as net bullish regardless of outcome. Either the supply gets locked up (bullish), America adds it to strategic reserves (bullish), or it fuels adoption in a post-sanctions Venezuela (bullish). Even if the claims prove exaggerated, the narrative alone reinforces Bitcoin's positioning as "digital gold" during geopolitical chaos.

Locally in Venezuela, reports indicate USDT usage surging as citizens anticipate either opportunity or further instability. A country already suffering hyperinflation may be doubling down on cryptocurrency as the only stable store of value available.

The Bigger Picture

Strip away the drama and you're left with a profound question: what happens when rogue nations discover cryptocurrency?

Venezuela's alleged strategy—assuming any significant portion of these reports proves true—represents sanctions evasion at a scale previously impossible. You can freeze bank accounts, seize gold shipments, block wire transfers. But Bitcoin, properly secured, is borderless and censorship-resistant by design.

The U.S. military can capture a president. It cannot as easily capture properly secured cryptocurrency.

This cuts both ways. For democracy advocates, it's troubling that authoritarian regimes found an escape hatch. For crypto enthusiasts, it validates everything they've said about decentralized money. For policymakers, it's a wake-up call about the limits of traditional sanctions.

The Credibility Question

We must return to the elephant in the room: these numbers remain unverified. Blockchain analysis hasn't confirmed Venezuelan control of anywhere near 600,000 BTC. The intelligence sources are anonymous. The calculations rely on estimates and assumptions.

Skeptics argue the figures may be exaggerated—perhaps deliberately—to manipulate market sentiment or justify military action. Maybe Venezuela accumulated 60,000 BTC instead of 600,000. Maybe the oil-to-USDT-to-BTC pipeline moved far less volume than reported.

Or maybe the whole thing is smoke and mirrors.

But here's what's not in dispute: Venezuela needed sanctions evasion tools. Cryptocurrency provided them. The regime had resources to convert (gold, oil) and means to do so (complicit partners, crypto exchanges willing to look away). And now that regime has fallen, leaving an information vacuum that intelligence services and crypto forensics teams are racing to fill.

What to Watch

The coming weeks and months will bring clarity (or at least more information).

Key indicators to monitor:

U.S. Treasury announcements: Any formal claims on Venezuelan Bitcoin holdings

Unusual blockchain activity: Large wallet movements from previously dormant addresses

Alex Saab's legal proceedings: Whether plea deals yield key recovery

On-chain forensics: Professional analysis firms tracking potential Venezuelan-linked wallets

Political signals from Venezuela: What a transitional government says about cryptocurrency reserves

If even 10% of the alleged holdings prove real and recoverable, we're talking about one of the most significant Bitcoin supply events in the cryptocurrency's 15-year history.

The Geopolitical Precedent

Regardless of final Bitcoin totals, the Venezuela episode establishes something crucial: major nation-states are paying attention to cryptocurrency as strategic asset.

Whether it's 600,000 BTC or 60,000, the strategy makes sense for any country facing financial pressure. Convert physical resources into digital assets.

Other sanctioned nations are watching. Iran, North Korea, Russia. Any government cut off from traditional financial systems now has a playbook.

The Hunt Continues

There may be private keys worth $67 billion.

The beauty and terror of Bitcoin is that until someone moves it, we simply don't know. Schrödinger's fortune: simultaneously the biggest heist opportunity in history and potentially nothing at all.

What we do know is that the intersection of geopolitics and cryptocurrency just got dramatically more interesting. And somewhere in a Brooklyn detention center, Nicolás Maduro may be the only person who knows if this story is legend or truth.