Balancer V2 Exploit: $120 M+ Hack Highlights Persistent DeFi Risk

What Happened: The Balancer V2 Exploit Unfolds

On November 3, 2025, the Balancer protocol suffered a major exploit of its V2 vaults, reportedly costing more than $120 million in stolen crypto assets across multiple chains including Berachain, Ethereum, Base, Optimism and others.

Source: LookOnChain

Significantly: the exploit impacted the Ethena/Honey “tripool” via the BEX on Berachain, and in reaction, the Berachain validators halted the chain and initiated an emergency hard-fork to manage fund recovery.

According to sources, the attacker took advantage of a smart contract vulnerability within Balancer’s “boosted pools” and the V2 vault architecture, allowing unauthorised withdrawals of wrapped staking assets (WETH, osETH, wstETH).

How It Was Done: Key Attack Vectors

The attacker exploited an access-control or callback vulnerability in the Balancer vault / pool code, enabling the balance or swap logic to be manipulated. CoinGape

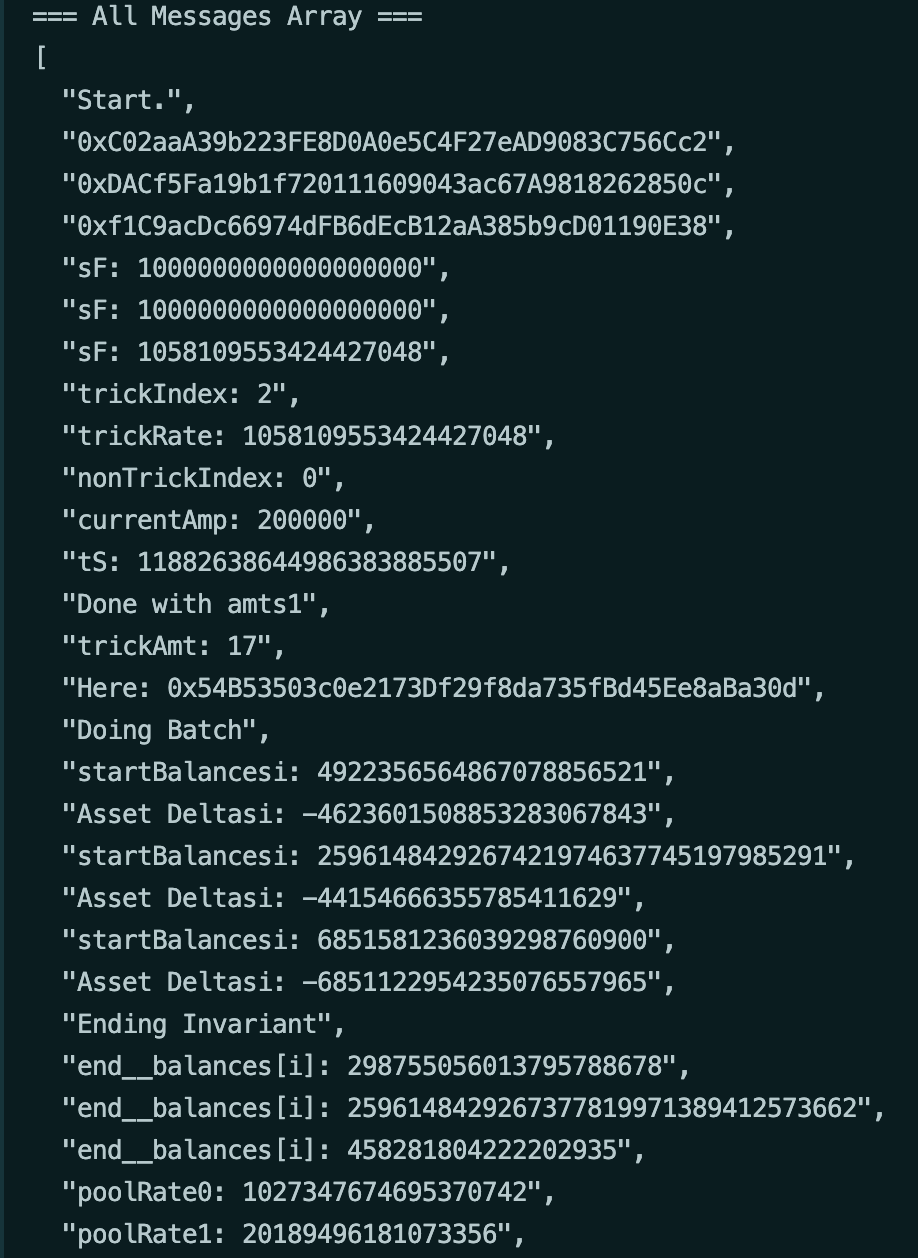

On-chain evidence shows the inclusion of console.log(...) statements left in production code, suggesting the exploit may have leveraged automated or LLM-generated code.

One analyst noted:

“When console.log appears on-chain, it’s almost always a mistake … forgeting to delete debug lines = copy-pasted straight from an LLM.”

Source: @AdiFlips

The multi-chain nature of the attack meant that funds were drained not only on Ethereum, but across chains, increasing complexity and exposure.

Immediate Fallout & Market Impact

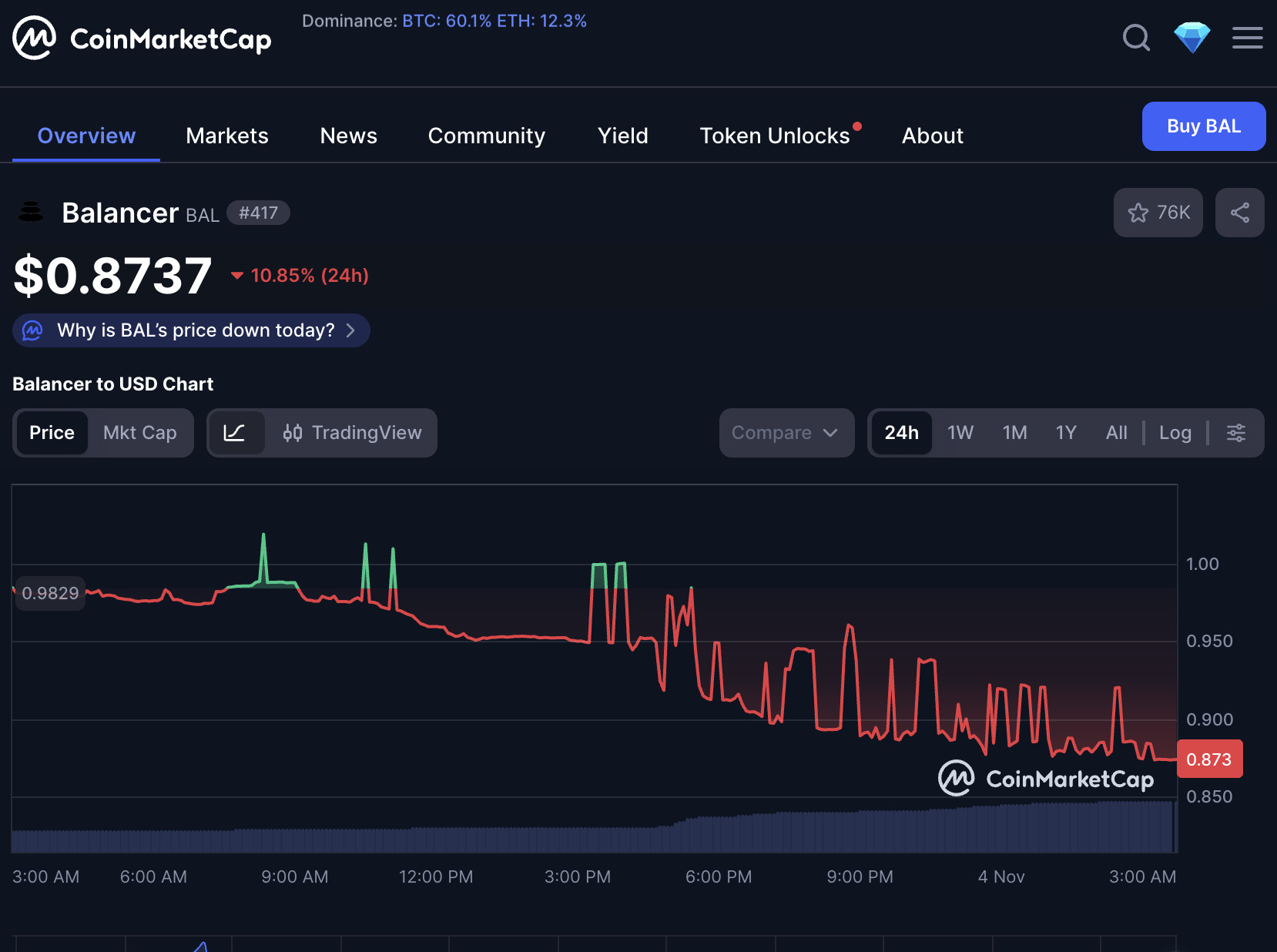

Source: CoinMarketCap

Token price drops: BAL, the native token of Balancer, fell sharply after news of the hack surface.

Liquidity drain: With over $120 M stolen, Total Value Locked (TVL) in affected pools will likely see significant withdrawals as LPs lose confidence.

Chain risk: The fact that Berachain halted its network to perform an emergency hard-fork, to protect funds and stop further damage, signals how serious the exploit is.

Broader DeFi sentiment: Even protocols with multiple audits are now clearly vulnerable, which may trigger a wave of scrutiny, de-risking behaviour and capital flight from high-yield risk pools.

Lessons & Implications for DeFi Risk Management

Source: @SuhailKakar

Audits ≠ Immunity: Despite multiple audits (Balancer vault audited 3 separate times by different firms) the hack still happened.

Cross-chain risk is real: The attack spanned chains and pools, meaning systemic risk in one protocol can propagate widely.

The importance of monitoring for debug artifacts: Strange onchain behaviour (e.g.,

console.logcalls) can be red flags for low-quality code or rushed patches.Have exit and incident plans: Projects and LPs should assume exploits can happen and have contingency plans (pause deposits, disable mints/redemptions, as Berachain did).

Community & protocol response matters: How quickly a team acts, how transparent the recovery is, and how funds are covered will influence future trust and capital flows.

What to Watch Going Forward

Investigations: Which pools were targeted exactly, how much was drained per chain, and how the attacker moves or launders funds.

Recovery/compensation: Will Balancer or its DAO cover losses for LPs? Will insurance protocols be triggered?

Governance and audit practices: Will this incident drive stricter audit protocols, runtime monitoring, and real-time crisis frameworks in DeFi?

Protocol-wide contagion: Watch other AMMs, boosted-pool architectures and forked protocols for vulnerabilities.

Regulatory attention: Big exploit numbers may accelerate regulatory pressure for DeFi protocols to have standardised security disclosures.

Bottom Line

The Balancer V2 exploit today is a stark reminder: no protocol, no matter how audited, is invulnerable.

For investors and builders: treat exploits not as rare anomalies, but as inevitable risk events. Wherever liquidity, leverage and composability meet, that intersection is a fault-line.

In DeFi, trust is fragile.

When it breaks, the ripple effects are real.