Election Eve 2025: Crypto Whales Move as Bitcoin Holds $105K and BNB Slips Below $1,000

Election Eve Calm Before the Storm

On November 4, 2025, the night before the U.S. presidential election, Crypto Twitter (CT) is unusually quiet.

But beneath that calm surface, the crypto market is moving fast. Whales are rotating positions, exchanges are logging record derivatives activity, and decentralized protocols are juggling exploits and governance votes.

Funding rates have flipped negative for the first time since October, fear and greed is sliding, and traders are bracing for how the election outcome could swing Bitcoin’s path from $109K to anywhere between $95K and $120K overnight.

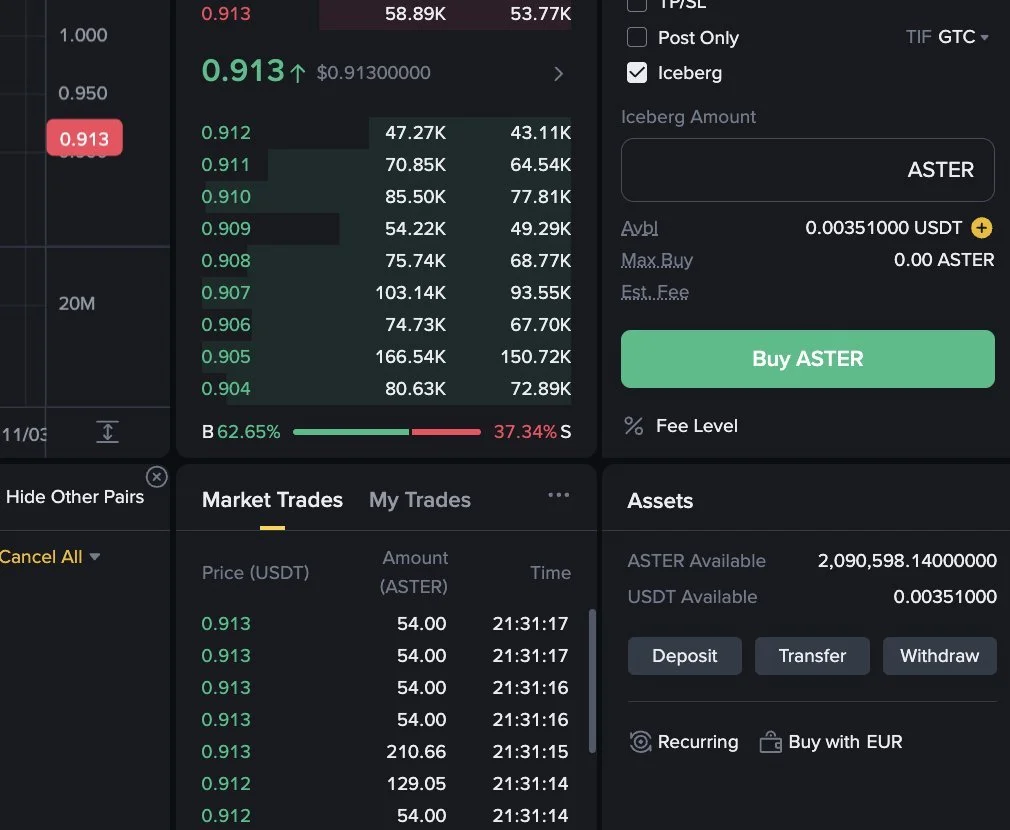

1. Binance Founder Changpeng Zhao Buys $2.46 Million in ASTER Tokens

Changpeng Zhao, founder of Binance, disclosed on November 2, 2025, purchasing approximately $2.46 million worth of ASTER tokens using personal funds on the platform, adopting a buy-and-hold strategy akin to his early BNB investment. Through his family office, YZi Labs, CZ provided early-stage investment in Aster's predecessor project, Astherus, prior to its 2024 merger with APX Finance to form the current platform, establishing a foundational tie that has fueled speculation about deeper involvement despite his public denials of direct operational control. The announcement drove ASTER's price up 30% to $1.25 within hours before a 21% decline to $0.97 amid over $71 million in whale short positions. ASTER serves as the token for a multi-chain DEX enabling perpetual and spot trading with up to 100x leverage, highlighting CZ's influence in the crypto market.

“Full disclosure. I just bought some Aster today, using my own money, on @Binance. I am not a trader. I buy and hold.”

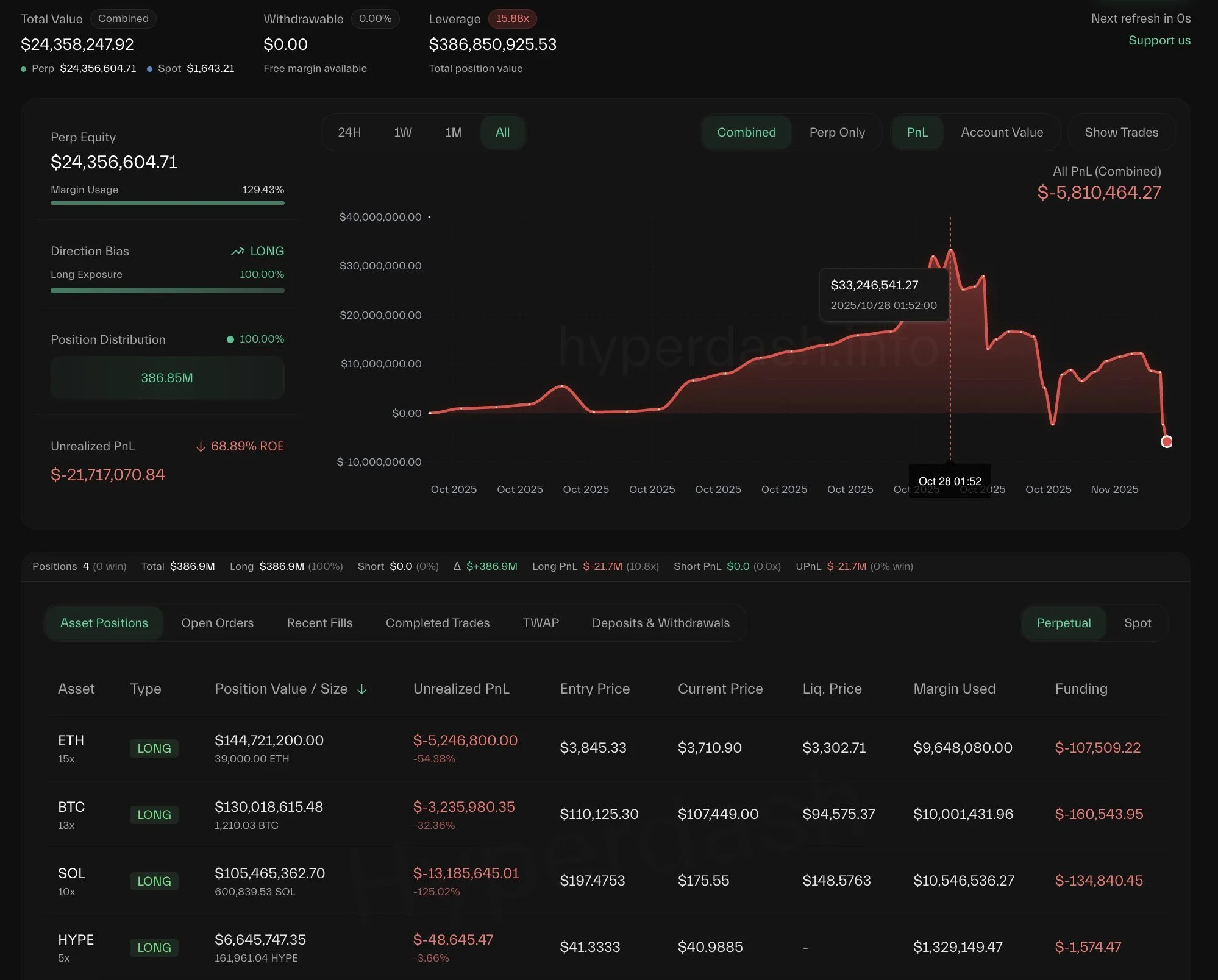

2. Anonymous Crypto Trader's 100% Win Streak Ends in $22M Losses

A previously flawless trader, wallet 0xc2a3, known for a 14-trade streak netting $33 million, was hit with $22.4M in unrealized losses after Bitcoin slid under $108,000.

Open longs in BTC, ETH, SOL, and HYPE reversed hard as the market shed $150 billion in total capitalization, triggering $463 million in liquidations. The streak ended just before key U.S. jobs data, underscoring how leverage-heavy sentiment can unravel in hours.

Source: https://x.com/WhaleInsider/status/1985245092358058479

3. Solana Captures Over 70% of Global Zcash Trading Volume

Solana has quietly become the top platform for Zcash (ZEC) trading, processing over 70% of daily ZEC volume, roughly $20M a day.

ZEC’s price has surged past $400, up 1,100% in three months, fueled by Zolana bridges and high-speed DEXs like Raydium, plus new perpetual markets on Drift and Flash Trade.

The trend cements Solana’s position as a cross-asset hub, even attracting endorsements from Zcash’s Electric Coin Company, signaling growing cooperation between privacy and performance ecosystems.

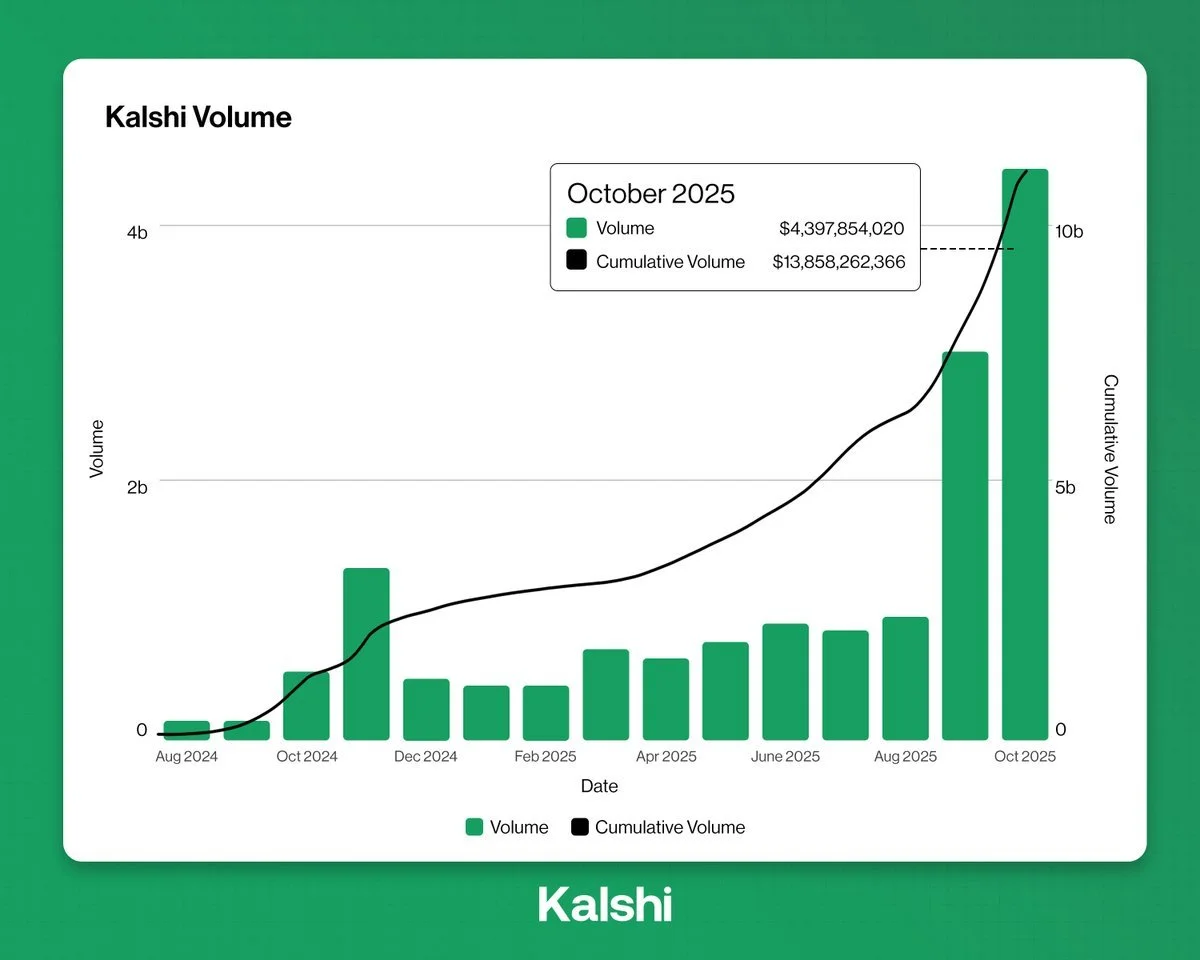

4. Kalshi did $4.4 Billion in Volume Last Month

Source: https://x.com/KalshiEco/status/1985369655725130163

Kalshi, the CFTC-regulated prediction market, hit a record $4.4 billion in trading volume during October 2025, outpacing Polymarket’s $3.02 billion.

High-profile events, from the New York mayoral race to the U.S. presidential election, fueled record participation. Kalshi capped the month with $1B traded in its final week, solidifying its role as a serious player in the event-driven finance space.

Bolstered by Robinhood integration and a $300M Series C at a $5B valuation, Kalshi’s expansion signals how prediction markets are becoming mainstream, blending retail speculation with institutional hedging.

5. Balancer Exploit Drains $120+M

Balancer suffered one of the largest DeFi exploits of 2025, losing $128.64 million in a flash-loan attack targeting its V2 Composable Stable Pools.

The vulnerability in its core vault access controls allowed attackers to withdraw WETH, osETH, and wstETH across Ethereum, Base, Polygon, Arbitrum, Optimism, and Sonic.

Emergency measures included halting affected pools, while V3 operations remained online. Berachain even initiated a hard fork to safeguard $12M in user funds, and Lido Finance pulled its positions amid market contagion fears.

Next 48 Hours: Catalysts to Watch

U.S. Election results: Polls close 7 p.m. EST. Any “crypto-friendly” soundbite could cause a market swing.

Fed speakers (Logan, Daly) on Wednesday, a dovish tone could flip funding rates positive again.

Expert Take: Calm Before the Liquidity Storm

The broader crypto market still looks structurally strong. Bitcoin up 62% year-to-date, institutional inflows steady, and layer-1 ecosystems expanding.

However, the short-term technicals flash caution: BTC’s 4-hour chart suggests a possible liquidity sweep before a post-election rebound.

In other words, this is the eye of the storm, calm, deceptive, and full of potential energy.

Final Word

From CZ’s surprise token play to record-breaking prediction volumes and multi-chain exploits, crypto markets are quietly preparing for an election-week shake-up.

The mood may feel subdued, but beneath the charts, billions are moving, across prediction platforms, DeFi protocols, and whale wallets.

Whatever happens after polls close, the next 48 hours could define the crypto narrative for the rest of 2025..