Bitcoin Holds at $103K Despite Massive OG Whale Movements: Why It’s Not Crashing

Historic Bitcoin Whales Are Moving Billions But the Price Isn’t Budging

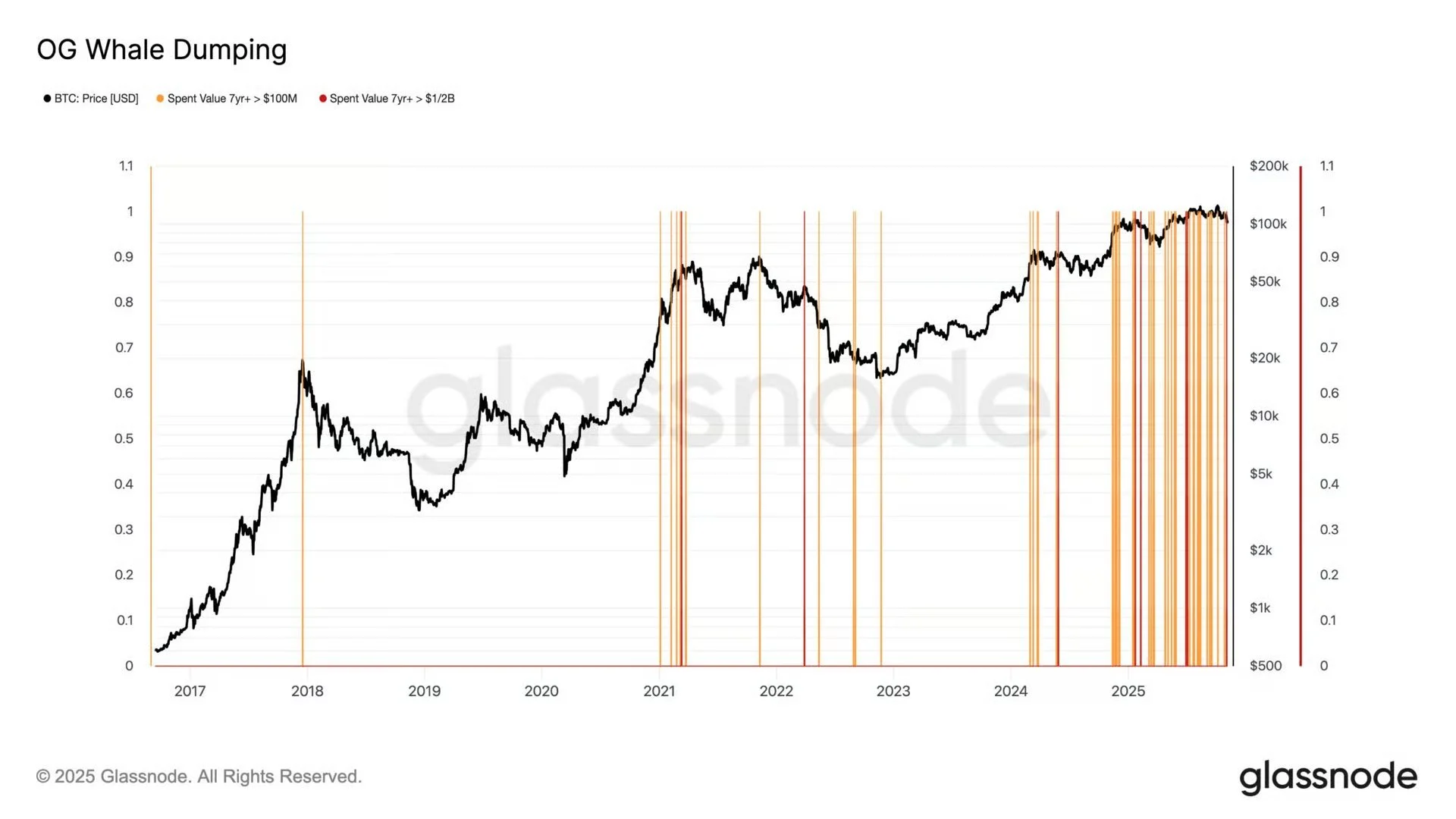

Bitcoin’s price has remained remarkably stable around $103,000, even as early investors, often referred to as OG whales, move massive amounts of BTC for the first time in years.

According to on-chain data from Glassnode, wallets that have been dormant for seven years or more have spent or transferred over 200,000 BTC (worth nearly $20 billion) since January 2025.

The chart, titled “OG Whale Dumping,” shows a dense cluster of orange and red lines in 2025, each representing significant transfers from long-term holders:

🟠 Orange lines = Spent value over $100 million

🔴 Red lines = Spent value over $500 million

Source: Charles Edwards

Yet, despite this visible on-chain selling pressure, Bitcoin continues to trade steadily above six figures.

Why Are Bitcoin OGs “Dumping”?

In simple terms: because they can.

Many of these early investors acquired Bitcoin when it traded below $10, meaning they’re now sitting on astronomical gains, often 10,000x returns.

After over a decade of holding, these early adopters are finally taking profits or diversifying into other assets such as Bitcoin ETFs or institutional custody solutions.

As Udi Wertheimer put it:

But Why Isn’t Bitcoin’s Price Crashing?

Normally, large sell-offs from early investors trigger panic and steep corrections.

However, in 2025, the opposite is happening. Bitcoin remains resilient above $100K.

Here’s why:

Institutional Demand is Absorbing the Supply

ETF inflows have surpassed $50 billion this year, meaning traditional investors are effectively buying up what the OGs are offloading.Not All “Dumps” Are True Sales

On-chain experts caution that what appears as selling could actually be wallet reorganizations, custody migrations, or collateral placements, not market dumps.Some OGs are moving coins to Taproot addresses for better security.

Others are posting BTC as collateral with banks like Sygnum for loans.

Some are seeding Bitcoin treasury entities, which repackage holdings under new structures without triggering taxable events.

Healthy Market Rotation

Long-term holders (LTHs) taking profits in bull cycles is a normal, healthy process.

What matters more is whether new demand can absorb the supply, and currently, institutional interest suggests it can.

What OnChain Analysts Are Saying

Analysts agree that context is key.

Long-term holder selling typically peaks near the end of bull markets, a pattern consistent with historical cycles.

The difference this time is how stable Bitcoin has remained despite months of sustained profit-taking.

Market Outlook: End of the OG Cycle?

As Bitcoin approaches what would traditionally be the end of a four-year market cycle, analysts suggest that OG whale distribution may soon taper off.

With institutional inflows steady and retail confidence returning, Bitcoin could be setting up for another leg higher once this round of profit-taking concludes.

The narrative of “OGs dumping” may dominate headlines, but the underlying story is one of maturity and absorption, proof that Bitcoin’s market is now deep enough to withstand billions in movement without breaking.