Trump Proposes $2,000 ‘Tariff Dividend’ for Most Americans: Here’s What It Means

Former President Donald Trump announced a bold new economic proposal on Truth Social on Sunday: using U.S. tariff revenues to fund direct $2,000 payments to most Americans. The plan, which he called a “Tariff Dividend,” would exclude high-income households and aims, according to Trump, to help reduce the $37 trillion national debt while sharing what he described as “the benefits of strong trade policy” with the American public.

What Trump Is Proposing

Trump’s plan centers on the idea that tariffs (taxes on imported goods) generate billions in revenue for the U.S. government. He wants to redirect those funds into cash payments for ordinary Americans, arguing that the country’s strong economy, record stock market, and low inflation make this feasible.

The former president also framed the initiative as a debt-reduction tool, suggesting that redirecting tariff revenues could reduce the need for new borrowing.

How Tariffs Work and What the Numbers Say

Tariffs are taxes placed on imported goods, typically paid by U.S. importers and passed along to consumers through higher prices.

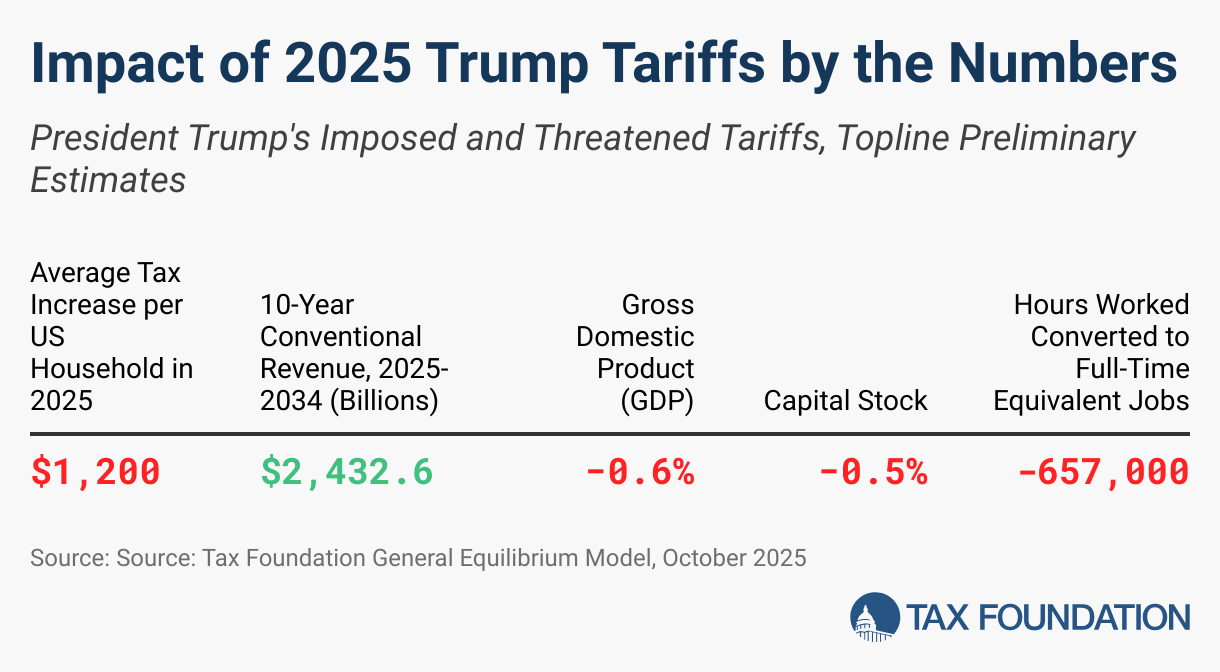

Source: Taxfoundation.org

According to the U.S. Treasury Department, tariff revenues currently total about $195 billion annually. That may sound large, but it’s a small fraction of the $6.5 trillion in total federal spending.

In real terms, that’s the equivalent of an average tax increase of $1,200 per U.S. household in 2025, rising to $1,600 in 2026.

If each eligible American received a $2,000 “dividend,” the program could cost roughly $500-600 billion, depending on eligibility limits. That means the plan would require far more than existing tariff revenues or major cuts elsewhere.

Can Tariffs Really Pay for a $2,000 Dividend?

Let’s do the math.

There are about 250 million eligible Americans (after excluding top earners). A $2,000 per-person dividend would cost roughly $500–600 billion, more than three times current annual tariff collections.

Even if tariffs raise $2.4 trillion over the next decade, as estimated by PIIE, that’s only about $240 billion a year before economic drag. Accounting for reduced growth and retaliation effects, real revenue would likely drop closer to $1.8 trillion over 10 years, or $180 billion annually.

In other words: the math doesn’t balance.

The Economic Impact: Who Really Pays

While Trump frames tariffs as a cost on foreign countries, economists across the political spectrum agree that U.S. businesses and consumers ultimately shoulder the burden.

Importers pay the tariffs, not exporters.

Those costs are then passed on to consumers through higher prices for goods like electronics, clothing, and vehicles.

According to PIIE, tariffs act as a hidden consumption tax, hitting middle- and lower-income households hardest.

So while Americans might receive a $2,000 “dividend,” they’d likely pay much of it back through higher prices at the store.

Supporters See It as an “America First Dividend”

Supporters argue that the policy reframes global trade, using tariffs as a form of patriotic profit-sharing.

They see it as a populist counterweight to traditional fiscal policies that favor corporations and the wealthy.

Trump allies say the payments would boost consumer spending, reward American manufacturing, and pressure foreign exporters (especially China) to lower prices or relocate production to the U.S..

What Happens Next

Trump’s “tariff dividend” proposal taps into a familiar populist message: America’s wealth should benefit Americans first.

But the underlying economics suggest that tariffs, already at historic highs, can’t sustainably fund large-scale direct payments without raising consumer costs or inflating the deficit.

The idea may resonate politically, but in practice, it highlights the trade-off between short-term populism and long-term fiscal discipline.

Tariffs may fund headlines, but not necessarily handouts.