Crypto Firm BTX Capital Accused of Manipulating POPCAT Token on Hyperliquid

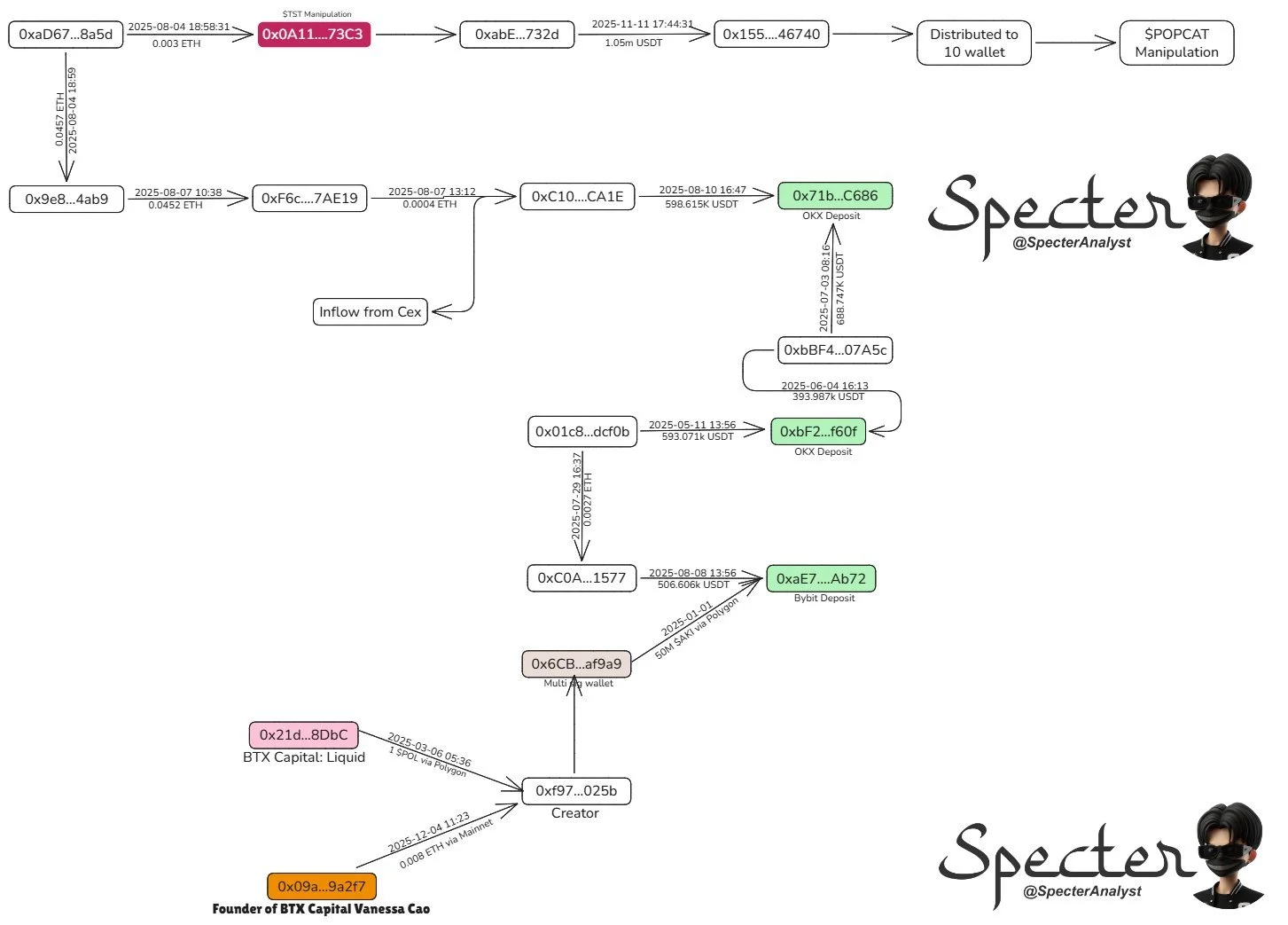

A new report is accusing crypto investment firm BTX Capital, and its founder Vanessa Cao, of being involved in a major token-manipulation scheme on the trading platform Hyperliquid.

The accusation comes from a crypto researcher on X (formerly Twitter), who says that BTX Capital may have played a key role in the sudden and violent price spike and crash of the meme coin POPCAT.

What allegedly happened?

According to the investigator:

Someone put a giant $25 million buy wall on POPCAT, making it look like huge demand was coming in.

The money was spread across many wallets, making it look like thousands of people were buying.

This tricked other traders into jumping in.

Then, the big buy orders were suddenly removed, causing POPCAT’s price to collapse instantly.

This crash triggered massive liquidations on Hyperliquid, causing the platform’s community fund (HLP) to lose about $5 million.

The investigator claims that wallet activity behind these trades is linked to BTX Capital and Cao’s public wallet address, suggesting they may have been behind the whole operation.

Why this is a big deal

If true, this is basically market manipulation, using large amounts of money and many fake wallets to artificially pump the price of a token, then letting it crash once others have bought in.

This matters because:

Regular traders can lose money without knowing why.

It hurts trust in decentralized trading platforms like Hyperliquid.

Big players using their capital to move markets creates an unfair playing field.

What Hyperliquid is facing now

Because the crash caused so many traders to be wiped out, Hyperliquid’s own liquidity pool (HLP) had to cover the losses, losing around $4.9 million.

This has raised concerns about whether:

Hyperliquid needs better protection against manipulation

There should be more monitoring of suspicious wallet activity

Memecoin trading with high leverage is too easy to abuse

Is anything proven yet?

No. These are on-chain allegations, not official charges. More researchers are now looking into the wallet links to confirm whether BTX Capital was involved or whether the trades were done by someone impersonating them.

Why people are talking about it

This event shows how easily the price of small tokens can be pushed around with enough money and smart timing. It also highlights how risky high-leverage meme-coin trading has become, especially on fast-growing decentralized platforms.