Massive Wash Trading Uncovered on Polymarket

Network Analysis Reveals Up to 60% of Polymarket Trading Volume in 2024 May Be Artificial

When you see a busy marketplace with millions in daily trades, you assume it's real. But what if 60% of that activity is an elaborate illusion? Columbia researchers just exposed the largest wash trading operation ever documented on a cryptocurrency platform and it reveals how easily modern markets can be manipulated.

Imagine walking into what appears to be a bustling stock exchange.

Traders are shouting, screens are flashing, millions of dollars are changing hands every minute.

You think: "This must be the real deal."

But then you discover that more than half the traders in the room are actually the same person wearing different disguises, trading with themselves to create the illusion of activity.

Researchers from Columbia University develop an algorithm to detect fake trading activity on cryptocurrency prediction markets, finding that wash trading peaked at nearly 60% of weekly volume in late 2024.

A comprehensive research study analyzing over 29 billion shares traded on Polymarket, one of the world's largest cryptocurrency-based prediction markets, has revealed widespread evidence of wash trading, a form of market manipulation where traders artificially inflate trading volume without taking genuine market positions.

What Is Wash Trading?

Wash trading is essentially fake trading. Imagine someone using multiple accounts to buy and sell the same assets back and forth, creating the illusion of high trading activity without actually risking any money or taking real market positions. It's like shuffling money between your own bank accounts to make it look like you're running a busy business but it's all smoke and mirrors.

This practice is illegal in the United States because it:

Distorts market signals: High volume typically indicates strong interest and conviction, but wash trading creates false signals

Misleads investors: People may invest based on artificially inflated activity levels

Manipulates rankings: Markets with higher volume get more visibility on platforms

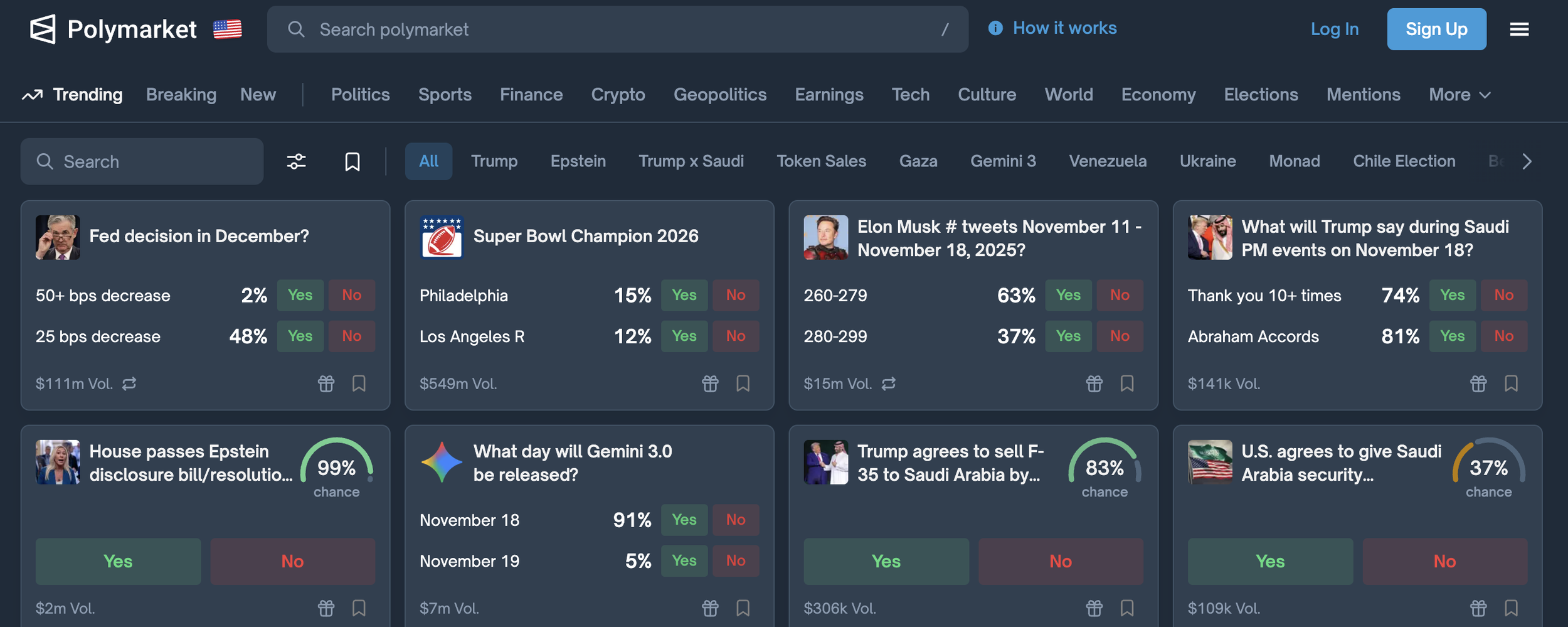

What Is Polymarket? The Wild West of Prediction Betting

Before we dive into the scandal, let's understand what Polymarket is and why it matters.

The Concept: Betting on Reality Itself

Polymarket is what's called a prediction market, essentially, a platform where people bet real money on whether real-world events will happen. Think of it as a stock market, but instead of buying shares in companies, you're buying shares in outcomes:

"Will Donald Trump win the 2024 election?"

"Will Bitcoin reach $100,000 by year-end?"

"Will the Lakers win the NBA championship?"

"Will there be a recession in 2025?"

Here's how it works: You can buy "Yes" or "No" shares for any prediction. If you're right when the event resolves, your shares are worth $1 each. If you're wrong, they're worth $0.

For example,

If "Yes" shares for "Trump wins election" are trading at 65 cents, that means the market collectively believes there's a 65% chance he'll win.

If you think the probability is higher, you buy "Yes" shares at 65 cents.

If Trump wins, you profit 35 cents per share. If he loses, you lose your 65 cents.

Why Prediction Markets Matter

Prediction markets have become increasingly influential because they often outperform traditional polls and expert forecasts. The theory is simple: when people risk real money, they're incentivized to be accurate. The "wisdom of the crowds" combined with financial stakes supposedly produces better predictions than any single expert.

Major investors, hedge funds, news organizations, and even governments pay attention to prediction market prices as indicators of what's likely to happen.

The Polymarket Phenomenon

Launched in 2020, Polymarket grew explosively, especially during the 2024 U.S. Presidential election. By October 2025:

$15.5 billion in total trading volume since 2022

29 billion shares traded across 100,000+ different prediction markets

Daily trading volume reaching tens of millions of dollars

Front-page news coverage during major events like elections

Unlike traditional betting platforms or stock exchanges, Polymarket operates in the cryptocurrency realm:

No identity verification required - Anyone can create an account anonymously

Cryptocurrency-based - Trades use USDC, a "stablecoin" pegged to the U.S. dollar

Zero transaction fees - You can trade as much as you want without paying commissions

Blockchain transparent - Every transaction is recorded on a public ledger (though identities remain hidden)

Officially, U.S. users are banned from Polymarket (due to regulatory issues), but this is easily circumvented with VPN technology, and enforcement is minimal.

The Dark Side: Perfect Conditions for Manipulation

While Polymarket's openness and accessibility made it popular, these same features created a perfect storm for manipulation:

Anonymous accounts mean one person can easily create thousands of fake identities

Zero fees mean manipulators can execute millions of fake trades without cost

No regulators watching means there's little risk of getting caught

Airdrop incentives (more on this later) meant massive financial rewards for appearing to be a high-volume trader

This brings us to the scandal that researchers just uncovered.

The Columbia Investigation: Following the Money Trail

Between November 2022 and October 2025, researchers from Columbia Business School's Decision, Risk, and Operations Division conducted the most comprehensive analysis of trading manipulation ever performed on a cryptocurrency platform.

What They Found: A Shadow Economy of Fake Trading

The investigation revealed something shocking: Nearly 25% of Polymarket's entire trading volume (billions of dollars) appears to be wash trading.

But that's just the average. The manipulation varied dramatically over time and across different types of markets.

The Columbia Investigation

Between November 2022 and October 2025, researchers from Columbia Business School analyzed Polymarket's complete trading history:

67.7 million trades

1.33 million wallet addresses

102,532 prediction markets

Every transaction recorded on the blockchain

What they found: Nearly 25% of all trading volume, roughly $3.75 billion, shows patterns consistent with wash trading.

But that's just the average. At peak in December 2024, approximately 60% of weekly volume appeared to be fake.

How Wash Trading Was Executed

Level 1: Simple Back-and-Forth

The pattern:

Alice buys 10,000 "Yes" shares at $0.50 ($5,000)

Bob buys 10,000 "No" shares at $0.50 ($5,000)

Together: $10,000 in volume, zero collective risk

No matter who wins, they break even

Real example: Wallets "MAY175" and "MAY176" traded the same 7,291 shares back and forth 90 times in 30 minutes, generating $700,000 in volume from essentially one trade looped 90 times.

Level 2: Triangle Trades

The pattern:

Alice buys with Bob

Bob sells to Charlie

Charlie sells back to Alice

All positions closed, but three "independent" transactions occurred

Real example: Wallet "nojkfaes" executed triangular trades across hundreds of wallets, generating $78 million in volume for a collective profit of just $1,469.

Level 3: Complex Chains

The pattern:

Account A buys shares, sells to B

B sells to C, C to D, D to E...

Continues through hundreds of accounts

Final account sells back to market

Real example: One trading chain with 985 transactions across 16 accounts in 24 hours.

Risk exposure: 95 shares

Volume generated: 100,000 shares

Level 4: Massive Clusters

The pattern: Thousands of accounts trading with each other in chaotic-seeming patterns, but carefully coordinated to maintain zero overall risk.

Real example: 1,200 wallets trading over 5 days:

99.8% of trading within cluster

$140 million in volume

Collective profit: -$57 (a $57 loss on $140 million)

This near-zero profit is a smoking gun, legitimate traders would see significant gains or losses.

Level 5: Mixing Real and Fake

The most sophisticated wash traders mixed legitimate activity to avoid detection.

Example: Wallet "Mazric" would make genuine trades with regular users, then execute massive wash trades with coordinated accounts, sometimes holding positions until resolution. One account profits, another takes the offsetting loss, looking like independent traders until network analysis reveals coordination.

The Smoking Gun Evidence

Evidence #1: Direct Money Transfers

Account "fengchu" received $36,600, then transferred exactly $5,000 each to six accounts within hours. Those accounts traded almost exclusively with each other, generating $193 million in volume for a collective profit of -$165.

Evidence #2: Systematic Naming

"MAY" Cluster: 200 accounts (MAY1, MAY2...MAY200) created within days, traded exclusively together, 116M shares, profit: -$57.86

"TenChar" Cluster: 43,011 accounts with random 10-character names, 188M shares, 93.4% within cluster, collective profit: -$9,872.93

Evidence #3: Coordinated Creation

Massive waves of account creation. Example: 1,811 accounts created in an 18-minute window on December 23, 2024.

Evidence #4: Impossible Profit Patterns

One account: $1.26 million in trading volume, $0.00 profit/loss, across 33 markets. The probability of this happening legitimately is essentially zero.

The Numbers That Tell the Story

Overall: 24.2% of all trading volume (7 billion shares, $3.75 billion) flagged as wash trading

Timeline:

2022-early 2024: Minimal wash trading, organic growth

July-December 2024: Surged to 60% of weekly volume (coinciding with airdrop speculation)

January-May 2025: Dropped to <5% (enforcement or caution)

September-October 2025: Resurged to 20% (problem persists)

By category:

Sports markets: 45% wash trading (peak: 90% in one week)

Election markets: 17% overall (but 95% in some minor elections)

Politics markets: 12% wash trading

Crypto markets: Only 3% (sophisticated traders deter manipulation)

The Detective Work: How They Caught It

Why Old Methods Failed

Previous detection looked for:

Self-trading (Polymarket banned this in 2023)

Closed loops (Sophisticated traders don't close loops)

Statistical anomalies (Easy to disguise)

Wash traders had studied these methods and designed around them.

The Breakthrough: Network Analysis

The key insight: Wash traders form isolated clusters that rarely interact with the broader market.

The algorithm:

Step 1: Score each account based on how often it closes positions quickly

Step 2: Analyze who trades with whom

High-scoring account trades with other high-scoring accounts? Increase its score

High-scoring account trades with diverse accounts? Decrease its score

Repeat until scores stabilize

Step 3: Identify clusters

Accounts that close positions quickly AND trade exclusively with similar accounts = wash traders

Why it works:

Legitimate day traders close positions quickly but trade with diverse counterparties (scores balanced)

Wash traders close positions quickly and trade only with their own accounts (scores reinforced)

The results: When tested against known wash trading clusters:

100% of "MAY" cluster flagged (200 accounts)

99.9% of "duichong" cluster (105 accounts)

94.4% of "Fantasy" cluster (514 accounts)

93.3% of "Lander" cluster (109,000+ accounts)

Few false positives—legitimate traders weren't wrongly flagged.

Why This Happened: The Perfect Storm

Factor 1: Airdrop Gold Rush

Polymarket was expected to launch a token distributed based on trading volume. More fake volume = more tokens potentially worth millions. Timeline matches: wash trading surged when airdrop speculation peaked.

Factor 2: Zero Fees

Most exchanges charge 0.1-0.5% per trade, making wash trading expensive. Polymarket: completely free. Generate unlimited fake volume at zero cost.

Factor 3: No Identity Verification

Creating thousands of accounts is trivial. No KYC = no way to link accounts to real people, no penalties.

Factor 4: Visibility = Volume

High-volume markets get homepage features, attracting more legitimate traders. Wash traders could boost any market they chose.

Factor 5: Weak Enforcement

Little evidence of active detection for most of 2024. The 2025 decrease suggests enforcement began, but October resurgence shows it's insufficient.

Major Wash Trading Operations

The "Lander" Network: 109,000 Accounts

932.7M shares traded

$79.9M in volume

94.1% within cluster

Strategy: Trade at fractions of a penny to maximize share volume per dollar

Collective loss: $64,160

The "81chain" Network: Parallel Coordination

12,036 accounts organized into 81 parallel trading chains

2.9M shares, $2.6M volume

85% within network

Collective loss: $666

The "Fantasy" Cluster: Sophisticated Disguise

514 accounts mixing real and fake trades

109.2M shares, $109.1M volume

99.8% within cluster

Collective profit: $1,346 (actually made money through sophisticated strategy)

Real-World Impact

Impact #1: Misleading Market Signals

During the 2024 election, major news outlets (NYT, WSJ, FT) regularly reported Polymarket odds. If 25-60% of volume was fake, those odds were less reliable than presented.

Impact #2: Unfair Airdrop Distribution

Legitimate traders with $100K real volume get tokens for that amount. Wash traders with $100M fake volume get 1,000x more tokens, theft from legitimate users.

Impact #3: False Growth Metrics

Headlines like "Polymarket hit $1 billion in monthly volume!" shaped narratives about prediction market adoption. If 25-60% was fake, these narratives misled investors, regulators, and entrepreneurs.

Impact #4: Undermining Trust

If a major platform has 25% fake volume, it damages credibility of the entire prediction market concept—potentially slowing adoption of valuable technology.

Impact #5: Real Money Lost

Wash trading clusters often lost money when legitimate traders "intercepted" their orders. The "Lander" cluster lost $64,000. Those losses were profits to unsuspecting legitimate traders.

Why You Should Care

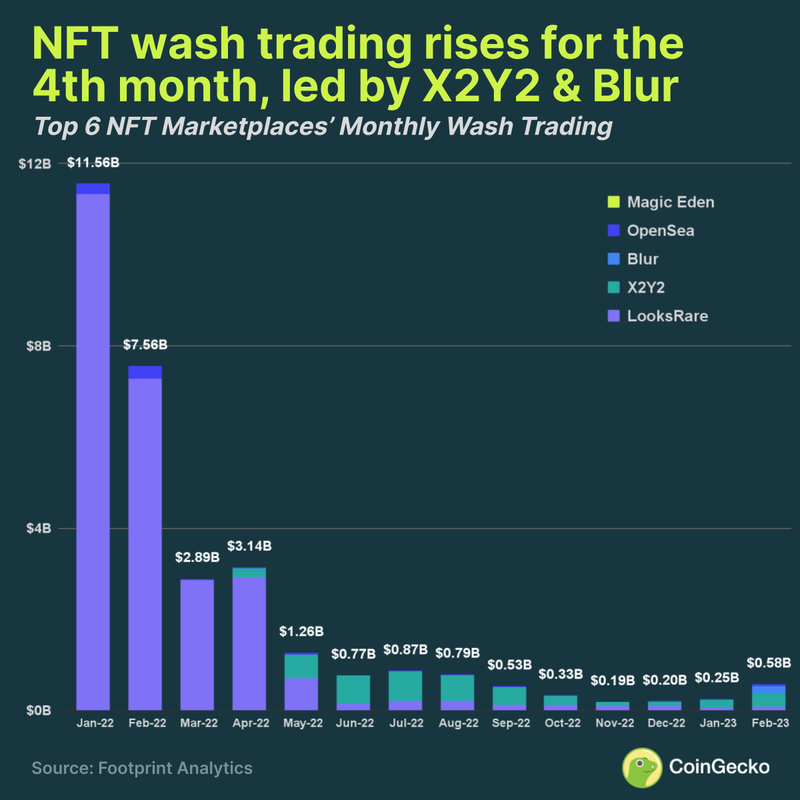

1. Wash trading isn't limited to Polymarket.

Research shows 70%+ fake volume on some crypto exchanges, 2-10% on NFT marketplaces.

Be more critical when evaluating high volumes on exchanges.

2. Media regularly reports prediction market odds.

Those odds may be less reliable than presented if significant volume is fake and affect the odds in the end.

3. The same vulnerabilities exist across many crypto platforms

These include having anonymous accounts, minimal fees, little oversight, volume incentives.

4. Surface metrics can be fraudulent.

The Columbia study shows sophisticated analysis can reveal truth. Apply similar scrutiny before committing resources.

5. The integrity of these markets affects how well society can anticipate and prepare for future events.

Prediction markets could be powerful forecasting tools. But only if they're real.

Solutions

1. Transaction Fees (0.1-0.5%)

Makes wash trading expensive instead of free. $1B fake volume would cost $1-5M in fees.

2. Identity Verification (KYC)

Can't easily create thousands of accounts. Real consequences for getting caught.

3. Better Detection

Implement network analysis algorithms like Columbia developed. Real-time monitoring stops wash trading before it accumulates.

4. Smarter Airdrops

Exclude wash trading from calculations. Weight by factors harder to fake: time as user, diversity of partners, genuine risk-taking patterns.

5. Alternative Metrics

Focus on harder-to-fake measures: open interest, unique traders, retention rates, liquidity depth rather than raw volume.

6. Regulatory Oversight

Bring prediction markets under frameworks similar to traditional exchanges. Legal consequences deter bad actors.

The Path Forward

What works: The core concept remains promising. When honest participants risk real money on predictions, incentives align toward accuracy and collective wisdom emerges.

What's needed: Trustworthy infrastructure that verifies identity, charges fees, monitors actively, enforces rules, reports transparently, and educates users.

What's promising: Emerging technologies like zero-knowledge proofs, reputation systems, AI detection, and blockchain analysis could help.

What's required: Cultural shift in crypto from celebrating "number go up" regardless of how, to celebrating platforms that maintain integrity.

Conclusion

The Columbia study reveals something profound: In a world where anyone can create unlimited fake identities and trade for free, the majority of market activity can be artificial.

At peak, 60% of Polymarket's weekly volume was likely fake. Billions in apparent trading was actually an illusion created by perhaps a few hundred people controlling hundreds of thousands of accounts.

The silver lining: The researchers created a solution. Their network-based algorithm can detect wash trading even when disguised through complex patterns.

The choice ahead:

Option 1: Continue with weak safeguards → Short-term inflated metrics, long-term collapse of trust

Option 2: Implement serious anti-fraud measures → Short-term metric decline, long-term sustainable growth

What you can do:

Be skeptical of volume metrics on any platform

Ask how platforms prevent manipulation

Support platforms that prioritize integrity

Demand transparency

Share this research

The next time you see headlines about prediction market odds or crypto trading volume, remember: it might be half real and half illusion. The Columbia researchers gave us the ability to tell the difference. Now we just need the will to look.

The Broader Context

Wash trading isn't unique to Polymarket. Research has found similar issues across cryptocurrency exchanges:

One study estimated that over 70% of volume on unregulated crypto exchanges could be wash trading

NFT marketplaces have documented wash trading rates of 2-10%

Even on regulated exchanges with KYC, detection remains challenging

However, Polymarket's combination of zero fees, anonymous accounts, and airdrop incentives created a particularly favorable environment for this manipulation.

Looking Forward

The study period ended in October 2025, with wash trading comprising about 20% of volume, down significantly from the 60% peak in late 2024, but still substantial.

The researchers note that:

Polymarket made efforts to curb wash trading in mid-2025, which may explain the decline

The resurgence in October 2025 suggests the problem persists

As detection methods improve, wash traders will likely adapt with more sophisticated strategies

The research represents a significant advancement in understanding and detecting market manipulation in cryptocurrency-based platforms. The network-based approach could be applied to other exchanges and trading platforms facing similar challenges.

Conclusion

This groundbreaking study reveals that wash trading on Polymarket reached extraordinary levels, with nearly a quarter of all historical trading volume showing patterns consistent with artificial manipulation. At its peak, fake trading may have accounted for 60% of weekly activity.

The findings serve as a wake-up call for cryptocurrency-based prediction markets and trading platforms. Without proper safeguards, such as transaction fees, identity verification, and sophisticated detection systems, these platforms remain vulnerable to large-scale manipulation that undermines their core purpose of aggregating collective wisdom and creating reliable market signals.

For users and investors, the message is clear: trading volume alone is not a reliable indicator of platform health or market conviction when wash trading is prevalent. More robust metrics and detection methods are essential for the future integrity of prediction markets and cryptocurrency exchanges.