Prediction Markets Are Beating the News and Forcing Media to Catch Up

Prediction markets sit at the intersection of finance, statistics, and human behavior. They allow people to buy and sell contracts tied to future events: elections, economic data, regulatory decisions, wars, or even cultural outcomes—at prices that reflect crowd-assigned probabilities.

A contract trading at $0.65 is not just a wager. It is the market’s collective statement that an event has a 65% chance of occurring.

Platforms like Kalshi, which operates under U.S. regulation, and Polymarket, which runs globally on crypto rails, represent two very different visions of what prediction markets are and what they should be.

Whether these markets are best understood as gambling or as forecasting tools depends less on their mechanics and more on how they are governed, who participates, and how their signals are used in the real world.

How Prediction Markets Work in Practice

Most prediction market contracts follow a simple structure: they pay $1 if an event occurs and $0 if it does not. Prices fluctuate based on supply and demand, implicitly encoding probability.

For example:

On Kalshi, traders can buy contracts like “Will U.S. CPI inflation exceed 3.0% this month?”, settled strictly against official government data.

On Polymarket, traders might speculate on “Will Donald Trump win the U.S. presidential election?” or “Will the SEC approve a spot Bitcoin ETF this quarter?”

In both cases, prices aggregate belief—but the incentives and guardrails differ sharply.

The Case for Prediction Markets as Forecasting Tools

They Often Beat Polls and Experts

Prediction markets have repeatedly demonstrated strong forecasting performance, particularly in elections and macroeconomic outcomes.

Unlike polls, participants risk real money. This discourages expressive or partisan answers and rewards accuracy over ideology.

In practice:

Polymarket’s election odds have often adjusted faster—and sometimes more accurately—than polling averages following debates, indictments, or major news events.

Kalshi’s markets on Federal Reserve decisions and inflation data frequently track professional forecasters and occasionally anticipate surprises before official releases.

The structure matters: being right is profitable, being wrong is costly.

They Aggregate Dispersed Information

Prediction markets excel at pooling insights from people with very different information sets.

A single contract on “Will the Fed raise rates at the next FOMC meeting?” may reflect:

economists modeling inflation

traders watching bond and futures markets

business owners reacting to credit conditions

Geopolitical markets blend insights from journalists, regional experts, analysts, and informed observers worldwide. No single participant sees the whole picture. Markets approximate it.

They Update in Real Time

Unlike polls or expert reports, prediction markets update continuously.

When news breaks, prices adjust within minutes. This makes them valuable not only for speculation, but for:

investors managing risk

journalists gauging momentum

policymakers seeking probabilistic signals instead of binary headlines

In effect, prediction markets function as living models of collective belief.

Kalshi vs. Polymarket: Two Philosophies

The difference between Kalshi and Polymarket is philosophical.

Kalshi’s approach:

compliance-first

objective settlement criteria

institutional credibility

gradual expansion

Its goal is to integrate prediction markets into mainstream finance and policy analysis.

Polymarket’s approach:

rapid market creation

global participation

crypto-native settlement

tolerance for ambiguity

Its goal is to become an open information layer for the internet.

One prioritizes durability and legitimacy. The other prioritizes speed and expressiveness.

When Prediction Markets Beat the News

This philosophical divide became visible during major real-world events most notably U.S. elections.

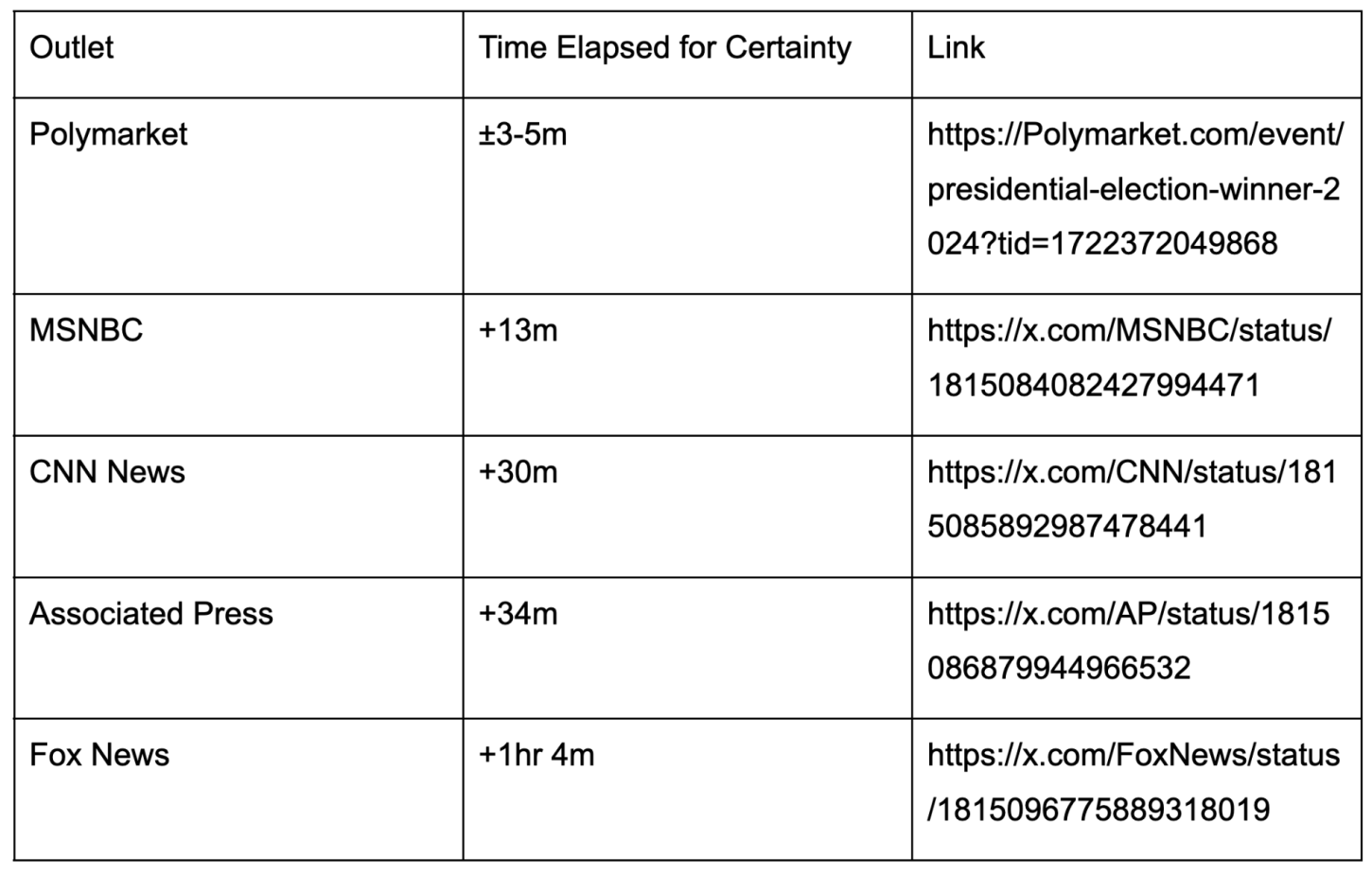

Based on timestamped data from the 2024 election:

Polymarket reached market certainty within 3–5 minutes

MSNBC followed roughly 13 minutes later

CNN followed around 30 minutes later

Associated Press confirmed at +34 minutes

Fox News followed more than an hour later

Markets converged first not because they “called” the election, but because financial consensus formed before editorial confirmation.

Why Media Is Quietly Paying Attention

News organizations cannot rely on prediction markets alone. They face legal, reputational, and ethical constraints that markets do not.

But behavior has shifted.

Journalists increasingly:

reference prediction market odds alongside polls

cite market probability shifts in live coverage

use markets to frame uncertainty rather than assert certainty

This mirrors how financial media once adopted bond yields and futures markets—first as curiosities, later as indispensable signals.

Kalshi’s regulated structure makes it attractive for macro coverage like inflation, rates, and government shutdown risk. Polymarket’s breadth and speed make it a reference point for elections, geopolitics, and crypto regulation.

What Prediction Markets Are Really Competing With

The deeper competition is not between platforms—it’s between ways of knowing.

Prediction markets challenge:

opinion polls

punditry

expert panels

narrative-driven media

They replace confidence with probability and certainty with price.

That makes them uncomfortable but also increasingly useful.

The Bottom Line

Prediction markets are neither magic nor menace. They are instruments.

When well-designed and properly governed, they can outperform traditional forecasting tools. When incentives skew toward entertainment or manipulation, they resemble gambling.

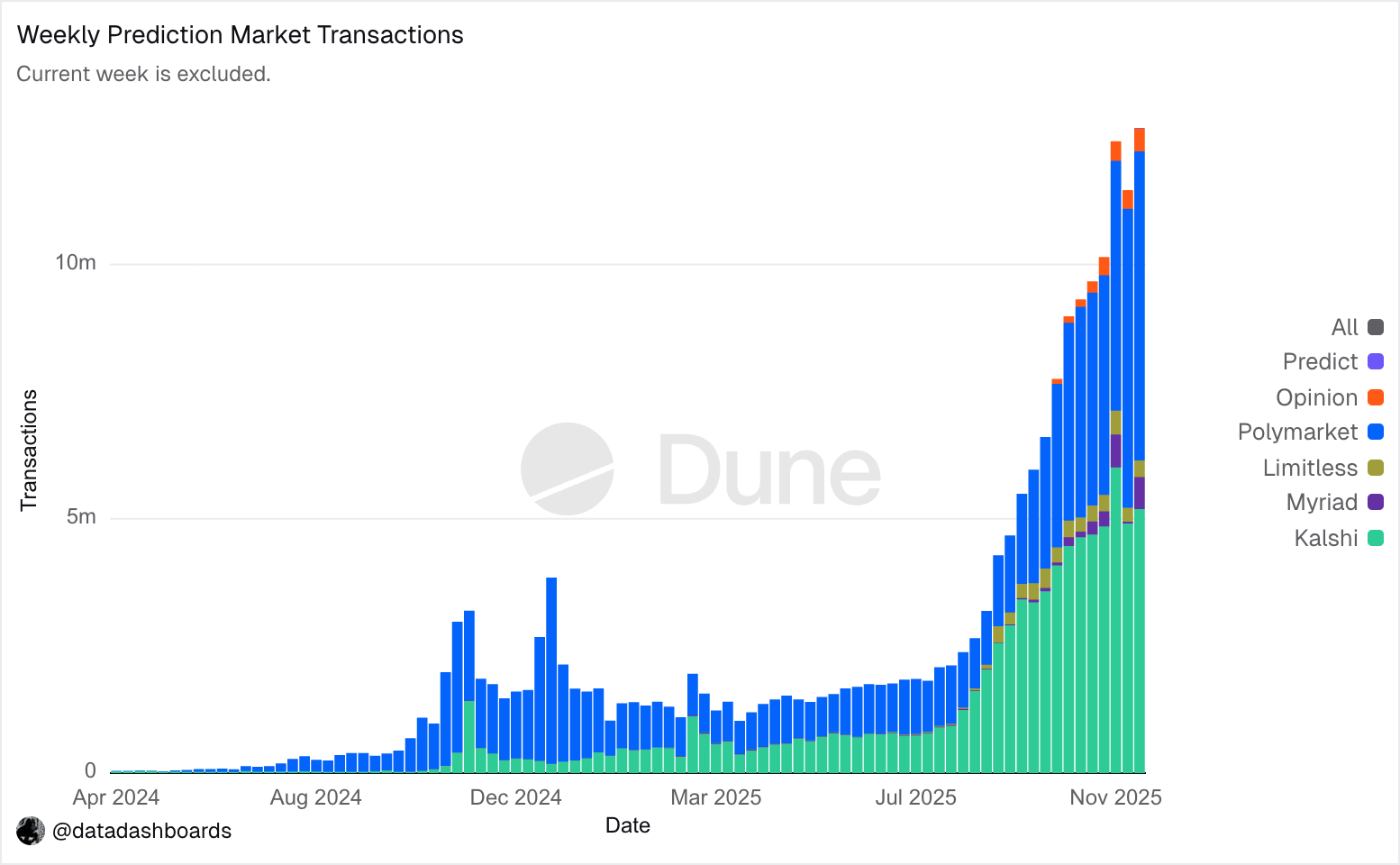

Kalshi and Polymarket represent opposite ends of that spectrum. As volumes grow and mainstream institutions begin to reference these markets, the line between “forecasting tool” and “information source” continues to blur.

In a world defined by uncertainty, no serious observer can afford to ignore prediction markets.