5 New Crypto Spot ETFs Launching in the Next 6 Days

The next week is shaping up to be one of the biggest ETF launch windows in crypto history.

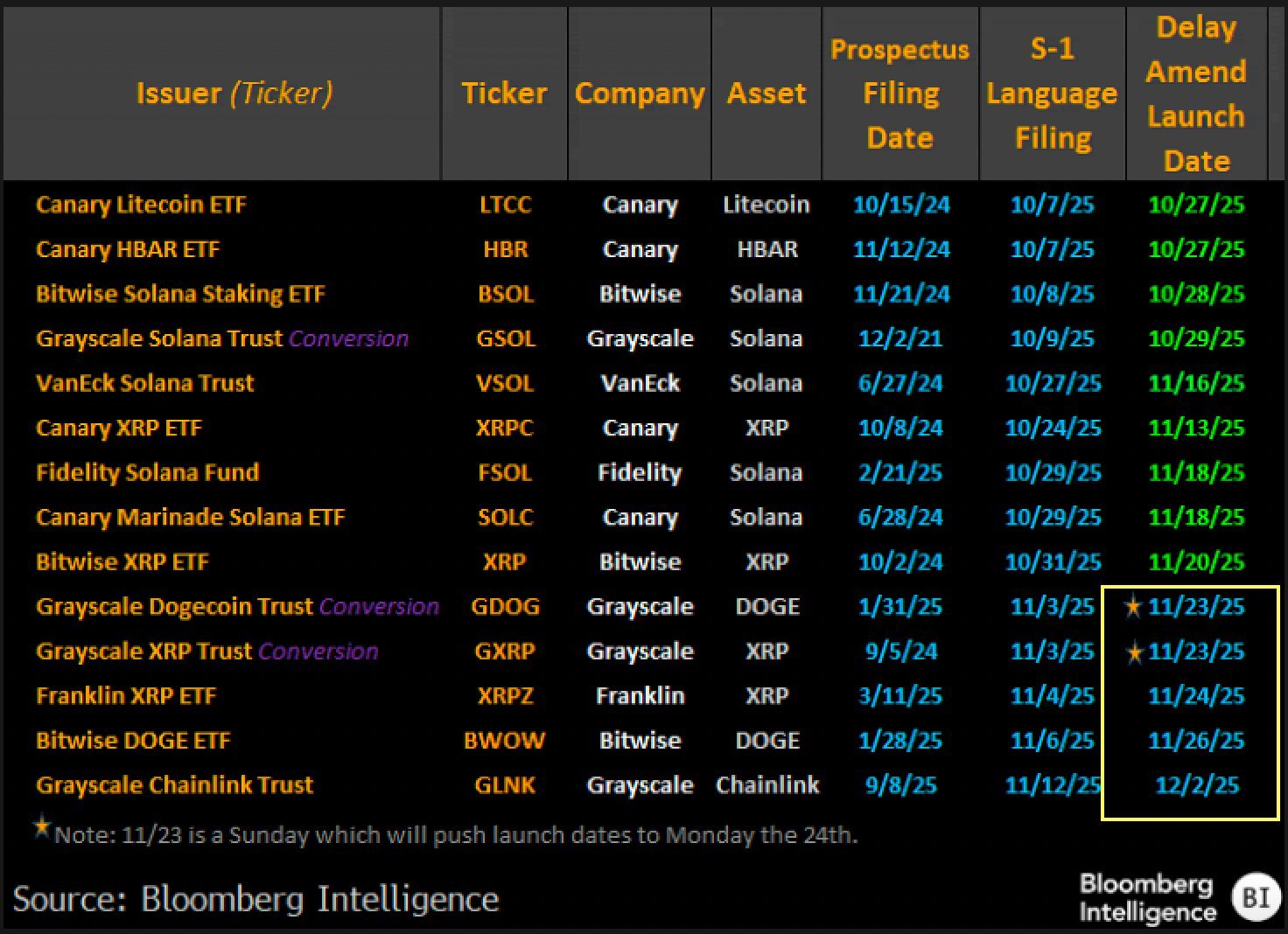

According to Bloomberg Intelligence, five new spot crypto ETFs are scheduled to debut over the next six days, covering major assets like XRP, DOGE, Chainlink, and Solana.

And this is just the beginning.

Analysts expect a steady stream of more than 100 additional crypto ETFs to hit the market over the next six months as issuers race to capture investor demand and diversify their crypto product shelves.

The chart (via Bloomberg Intelligence) shows what has already launched, what’s in the pipeline, and the specific ETFs poised to go live over the next few days.

What’s Launching in the Next Six Days?

Highlighted in the chart are five spot ETFs slated for launch between November 23–December 2, 2025:

Grayscale Dogecoin Trust — Nov 23

Grayscale XRP Trust — Nov 23

Franklin XRP ETF — Nov 24

🔹 Bitwise DOGE ETF — Nov 26

🔹 Grayscale Chainlink Trust — Dec 2

These ETFs represent yet another wave of mainstream assets entering regulated markets, giving investors exposure beyond Bitcoin and Ethereum.

Why This Matters: The ETF Flood Is Just Beginning

Bloomberg analysts note that while only a handful of ETFs are going live this week, the real story is the pipeline, which is set to explode.

Expect 100+ new crypto ETFs in the next six months

Issuers like:

Grayscale

Canary

Bitwise

VanEck

Fidelity

Franklin

BlackRock (expected filings)

…are all pushing aggressively into multi-asset exposure.

We are likely entering a phase where every major L1, L2, staking derivative, and institutional-grade chain gets its own ETF wrapper.

What’s Already Filed?

From the chart:

Multiple Solana ETFs (Bitwise, Fidelity, VanEck, Canary)

XRP ETFs from Bitwise, Franklin, and Grayscale

Marinade SOL and Solana Staking ETFs

Chainlink, DOGE, HBAR, and Litecoin products

Many of these filings have already completed their S-1 language, meaning the regulatory process is advancing quickly.

What’s Driving the ETF Boom?

1. Mainstream demand for diversification

Investors want exposure beyond Bitcoin.

2. Regulatory clarity improving

Especially around commodity vs. security classifications.

3. Institutions expanding their product lines

ETFs remain the cleanest, easiest way to bring crypto to traditional markets.

4. The success of spot Bitcoin and Ethereum ETFs

Billions in flows have proven investor appetite is real.

The Bottom Line: A Historic Expansion in Crypto Market Access

This upcoming batch of ETF launches marks the largest multi-asset ETF roll-out crypto has ever seen.

Solana, XRP, Chainlink, Dogecoin, and others are about to enter millions of brokerage accounts via Fidelity, Schwab, Vanguard, BlackRock, and more.

The stage is set for a massive broadening of crypto participation across retail and institutions alike.

The next six days kick off a cycle that could reshape portfolio construction through early 2026.