Vitalik Buterin Calls Developers Back to Ethereum Layer 1 as Gas Fee Falls

Ethereum Layer 1 just became cheap again.

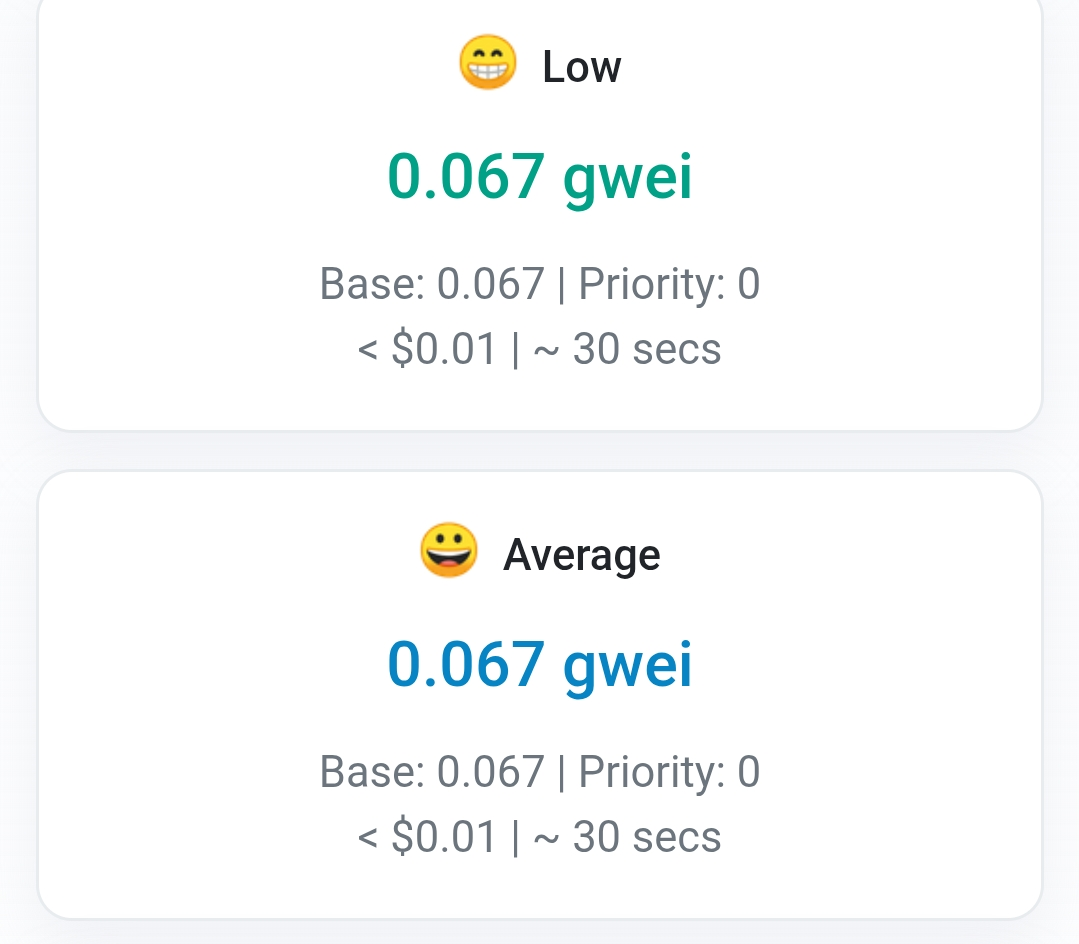

On December 1, 2025, gas prices fell to 0.067 gwei, making simple transactions cost less than one cent.

Vitalik responded with a clear message:

This comes after a major November 25 upgrade that increased the gas limit to 60 million, alongside more efficient client software, cheaper hardware requirements, and continually improving block propagation.

Ethereum L1, long considered “too expensive to build on”, is suddenly practical again.

The Current State of Ethereum L2s: Powerful, But Deeply Fragmented

Ethereum’s rollup-centric roadmap has produced extraordinary progress. Since 2022, L2s have lowered fees, increased transaction throughput, and created an environment where new experiments can flourish without risking mainnet safety. The modular approach has allowed Ethereum to scale horizontally: instead of one superchain, Ethereum now has dozens of execution layers.

However, the rapid growth of L2s has also created unintended consequences.

Today, the Ethereum ecosystem includes a sprawling list of L2s and L2-adjacent chains, including Arbitrum, Optimism, Base, Zora, Scroll, Linea, Starknet, zkSync, Blast, Mode, Mantle, Taiko, Berachain L2, and emerging entrants such as Abstract. Each chain introduces its own token economics, bridging solutions, incentive structures, fee models, user flows, and developer tooling.

This diversity drives innovation, but it also results in fragmentation across several critical dimensions:

Liquidity Fragmentation

Capital is spread thin across dozens of chains. Many L2s have short-lived liquidity due to incentive campaigns, and liquidity often disappears once rewards end. This creates inconsistent DeFi depth and makes it harder for dApps to operate sustainably across multiple networks.

User Experience Fragmentation

Users must manage gas tokens unique to each L2, configure different RPCs, handle bridging workflows, and navigate unfamiliar ecosystems. This complexity weakens the overall user experience and limits cross-chain retention.

Developer Fragmentation

Developers are increasingly forced to choose a “home” L2 based on incentives, expected user traffic, or integration support. Building cross-L2 applications requires significant infrastructure investment, and choosing an L2 that fails to gain traction can severely impact a project’s long-term prospects.

Ecosystem Fragmentation

Instead of one unified Ethereum execution environment, developers now contend with a patchwork of semi-isolated networks. Although this was expected in the early stages of the rollup roadmap, the sheer number of L2s has made interoperability a persistent challenge.

This fragmentation sets the stage for why Vitalik’s comment landed with such weight.

Why Vitalik’s Message Matters Now

Vitalik’s encouragement to build on L1 is not a rejection of L2s. It is a recognition that the fundamentals of L1 have changed.

Several technical advancements converged in late 2025 to make Ethereum’s base layer significantly cheaper and more efficient:

1. The Gas Limit Increased to 60 Million

This major upgrade on November 25th allowed more computation per block, directly reducing the average cost of many operations.

2. Execution Clients Became Much More Efficient

Improvements from teams such as Geth, Erigon, Nethermind, and Reth have lowered hardware requirements, improved sync speeds, and optimized block propagation.

3. Hardware Costs Declined

Cheaper, faster hardware has made it more affordable to run nodes and validate network activity, indirectly supporting lower gas fees.

4. Blobs Moved High-Volume Activity Off L1

With the introduction of proto-danksharding and blob transactions, much of the transaction pressure that previously congested Ethereum L1 has shifted to L2s, leaving room for more stable, low-cost execution on the base layer.

In short, the combination of technological improvements and lower demand has temporarily restored Ethereum L1 to a state where developers can build simple applications without worrying about unpredictable gas spikes.

This shift forces L2s to rethink how they position themselves in the broader Ethereum ecosystem.

What This Means for L2 Companies Like Abstract, Base, Arbitrum, and Optimism

Vitalik’s nudge does not diminish the role of L2s. Instead, it elevates the standards by which L2s must compete. The L2 landscape is now transitioning from “cost-focused” differentiation to value-focused differentiation.

1. L2s Must Offer More Than Cheap Transactions

With L1 temporarily offering near-L2-level fees, rollups must differentiate through superior:

user onboarding

ecosystem depth

developer incentives

liquidity networks

specialized tooling

governance structures

sequencer decentralization

L2s that simply provide faster and cheaper blockspace will struggle to retain meaningful traction.

2. The L2 Market Is Likely Headed Toward Consolidation

The ecosystem cannot support dozens of general-purpose rollups indefinitely. The most likely survivors are:

Base, due to Coinbase’s user funnel and focus on consumer apps

Optimism, due to its Superchain vision and widely adopted OP Stack

Arbitrum, due to its deep DeFi footprint and Orbit ecosystem

Starknet / zkSync, due to technical differentiation with zk proofs

Abstract, due to its focus on interoperability and cross-chain coherence

Smaller L2s may become L3s on top of larger networks, merge with others, or simply fade as liquidity departs.

3. Specialization Will Define the Next Era of L2s

Instead of general-purpose chains competing for the same users, we will see the rise of:

gaming-specific rollups

social and identity rollups

AI-optimized execution layers

RWA and institutional chains

app-specific chains powered by shared sequencing

high-frequency trading execution layers

Abstract is one example of a chain positioning itself as a unifying interoperability layer rather than just another environment for cheap execution.

4. Sequencer Decentralization Will Become a Competitive Advantage

As L1 becomes more affordable and continues to demonstrate unmatched neutrality and security, users will increasingly demand similar guarantees from L2s. Rollups that decentralize their sequencers—or adopt shared sequencing frameworks such as Espresso or Astria—will enjoy higher trust.

The Future of Ethereum: A Hybrid Model of L1 and L2 Harmony

Vitalik’s comment should not be read as signaling a move away from L2s. Instead, it highlights a more nuanced understanding of Ethereum’s long-term architecture. Ethereum’s future is not a choice between L1 and L2, but a hybrid where each fulfills a distinct and complementary purpose.

L1 becomes the stable, neutral, secure base layer for settlement, identity, governance, lightweight apps, and high-value transactions.

L2s become the high-throughput execution environments that handle intense workloads, gaming, DeFi, and consumer-scale systems.

L3s and appchains emerge as specialized, domain-specific environments for vertical use cases.

With L1 fees temporarily low, developers now have a broader range of choices. Some applications that migrated to L2 out of necessity may return to L1, while others will continue to flourish within L2 ecosystems that offer strong community, liquidity, and tooling.

The key question for every L2 team is now:

“What unique value do we offer that L1 does not?”

Those who can answer this clearly will thrive. Those who cannot may find themselves absorbed into the next wave of consolidation.